The US Economy Thread

+12

I Have Mono

RedOranje

sportsczy

CBarca

RealGunner

Grooverider

Kaladin

zizzle

Swanhends

kiranr

Yuri Yukuv

BarrileteCosmico

16 posters

Page 4 of 8

Page 4 of 8 •  1, 2, 3, 4, 5, 6, 7, 8

1, 2, 3, 4, 5, 6, 7, 8

Re: The US Economy Thread

Re: The US Economy Thread

@Zizzle

You keep jumping back and forth

If you are talking about the stock market then its fairly valued as compared to '08, especially when we take into account that corporate profits are higher per share of S&P. You are buying $1 of stock for a larger amount of profits and much less leverage. Warren buffet has the same view, he uses market cap/GNP as his main metric.

If you are talking about the economy then you are 1000% right, it is not as strong as it was in the mid 2000s. This is for a variety of reasons which include: demographic trends (americans and europeans getting older), tight money supply, less capital expenditure, much more competitive labor overseas especially in asia and technology developing in a way that is more towards cost cutting and less consumption.

Some catalysts for the US market are still there which include growth in the housing market, growth in shale production and commodity prices falling off (more discretionary spending).

You keep jumping back and forth

If you are talking about the stock market then its fairly valued as compared to '08, especially when we take into account that corporate profits are higher per share of S&P. You are buying $1 of stock for a larger amount of profits and much less leverage. Warren buffet has the same view, he uses market cap/GNP as his main metric.

If you are talking about the economy then you are 1000% right, it is not as strong as it was in the mid 2000s. This is for a variety of reasons which include: demographic trends (americans and europeans getting older), tight money supply, less capital expenditure, much more competitive labor overseas especially in asia and technology developing in a way that is more towards cost cutting and less consumption.

Some catalysts for the US market are still there which include growth in the housing market, growth in shale production and commodity prices falling off (more discretionary spending).

Yuri Yukuv- First Team

- Posts : 1974

Join date : 2011-06-05

Re: The US Economy Thread

Re: The US Economy Thread

Well lets just say that corporations are in a good shape but the current rally does not reflect any discount for macroeconomic events such as ending the QE and increasing the interest rates.

zizzle- Fan Favorite

- Club Supported :

Posts : 6887

Join date : 2011-06-05

Age : 104

Re: The US Economy Thread

Re: The US Economy Thread

http://blogs.reuters.com/felix-salmon/2013/05/22/dont-fear-the-bubble/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+felix-all+%28Felix+Salmon+-+All+%28Reuters+%2B+FS.com%29%29

I agree with this guy in that the distinction between a bull market and a bubble is really key. Will stocks go down when the accomodative policy ends and interests are allowed to raise? Probably. Does it mean that investors are irrationally purchasing stocks? Not really, only a difference in investor preferences.

Looking at the markets today, they show every indication of being bull markets rather than bubbles. For one thing, there’s not much speculation going on: no one’s day-trading junk bonds. Eisinger says that the One Percent are getting wealthier “through speculation”, and cites private-equity firms in the “house flipping” business, but that’s really not what’s going on at all: the One Percent are getting wealthier just because they own stocks and those stocks are going up, while the private-equity firms buying houses aren’t flipping them, but are rather renting them out, as part of their global search for yield. That’s real investment, it’s not speculation. What’s more, when Eisinger points to this chart as evidence that stocks are overvalued, he’s pointing to a chart which shows that — except for a deep “V” at the very height of the financial crisis — shows stocks trading at pretty much their lowest valuation of the past 20 years. Nasdaq 5,000 this is not.

I agree with this guy in that the distinction between a bull market and a bubble is really key. Will stocks go down when the accomodative policy ends and interests are allowed to raise? Probably. Does it mean that investors are irrationally purchasing stocks? Not really, only a difference in investor preferences.

BarrileteCosmico- Admin

- Club Supported :

Posts : 28386

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

Japan is going nuts, if they dont resolve the JGB issue soon everyone will be in trouble.

Kuroda talks like greenspan does, IE in gibbirish.

Kuroda talks like greenspan does, IE in gibbirish.

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 79

Re: The US Economy Thread

Re: The US Economy Thread

What a great man, the Ronal of our days

Japan Is Back

A Conversation With Shinzo Abe

After serving a brief, undistinguished term as Japan’s prime minister in 2006–7, Shinzo Abe seemed destined for the political sidelines. Then, last December, he surged back into the limelight, retaking office in a landslide victory. The return to power of his Liberal Democratic Party (LDP) -- which has run Japan for 54 of the last 58 years, including most of the last two “lost decades” -- initially worried investors and pundits. But Abe immediately embarked on an ambitious campaign to revive Japan’s economy, and, some six months later, his efforts seem to be paying off. On the foreign policy front, however, Abe -- known in opposition as a conservative nationalist -- has sparked controversy by seeming to question Japan’s wartime record. In mid-May, as tensions were rising with Japan’s powerful neighbors, he spoke with Foreign Affairs managing editor Jonathan Tepperman in Tokyo.

This is your second tenure as prime minister. Your first was not so successful, but this time, everything seems different: your approval rating is over 70 percent, and the stock market is at a five-year high. What lessons did you learn from your past mistakes, and what are you doing differently this time?

When I served as prime minister last time, I failed to prioritize my agenda. I was eager to complete everything at once, and ended my administration in failure.

After resigning, for six years I traveled across the nation simply to listen. Everywhere, I heard people suffering from having lost jobs due to lingering deflation and currency appreciation. Some had no hope for the future. So it followed naturally that my second administration should prioritize getting rid of deflation and turning around the Japanese economy.

Let’s say that I have set the priorities right this time to reflect the concerns of the people, and the results are increasingly noticeable, which may explain the high approval ratings.

I have also started to use social media networks like Facebook. Oftentimes, the legacy media only partially quote what politicians say. This has prevented the public from understanding my true intentions. So I am now sending messages through Facebook and other networks directly to the public.

So that way you get to bypass journalists?

Sort of [laughs]. No, I attach importance to face-to-face interviews like this one, and I have never been media shy. My point was that what I actually mean sometimes gets lost when it is only partially -- even mistakenly -- quoted.

You’ve said that your economic agenda is your top priority. Abenomics has three “arrows”: a 10 trillion yen fiscal stimulus, inflation targeting, and structural reform. You’ve fired the first two arrows already. What will the third look like?

The third arrow is about a growth strategy, which should be led by three key concepts: challenge, openness, and innovation. First, you need to envision what kind of Japan you wish to have. That is a Japan that cherishes those three concepts. Then, you get to see areas where you excel. Take health care, for instance. My country has good stock, which enables Japanese to live longer than most others. Why not use medical innovation, then, both to boost the economy and to contribute to the welfare of the rest of the world?

My recent trip to Russia and the Middle East assured me that there is much room out there for Japan’s medical industries. The same could be said for technologies to reduce carbon dioxide emissions, of which Japan has plenty. But to foster innovation, you must remain open.

But Japan has constraints on its economy that keep it from growing: high agricultural subsidies, overregulation, underutilization of women, a poor immigration policy. Past prime ministers have tried to deal with these problems and have run into a wall. What reforms will you focus on?

Time is not on our side. Prolonged deflation and the resulting economic stagnation that has lasted for 15 years have kept my country almost standing still, while the rest of the world has gone far. This is the last chance for us, and the sense of urgency is therefore enormous. It’s shared more widely than ever before among my fellow lawmakers.

True, agriculture still matters, not only as an industry but also for keeping Japan’s social fabric well knit. But my approach is to make it stronger and export-oriented. Japanese farmlands are endowed with rich natural attractions. Let them simply be sold more to the world. Where necessary, we will cut red tape, for sure. More investment in core technologies is also important, as is foreign direct investment in Japan. We must do all this now, in one fell swoop.

As for openness, of special note is my decision on the TPP [Trans-Pacific Partnership]. Previous administrations were indecisive. I decided to enter into the TPP negotiations. Of course, the agricultural lobby is fiercely against it, and agricultural associations are among the biggest and most important supporters of the LDP. So we are working hard to bring them along. If we don’t change, there won’t be any future for Japanese agriculture, or for Japan’s regions and local communities.

You’ve launched a major stimulus program that has been successful so far. But aren’t you worried about Japan’s debt, which is already at 220 to 230 percent of GDP?

Japan is facing an extremely rapid decline in birthrates, and Japan’s national income has lost as much as 50 trillion yen due to prolonged deflation. Put those together, and you get a much smaller tax base. That is why we are facing a very difficult financial situation, and that was the core concern that led my government to launch the “three arrow” recovery plan.

The bond repurchase and interest payments aside, the government’s current spending must meet its annual tax revenue. To achieve that balance remains our first priority, and we have made an international pledge to do so. By fiscal year 2015, we are going to halve our primary-balance deficit, and by 2020, we will achieve balance. To do so, we have to increase tax revenue. We also need to end the deflationary cycle. And we have to achieve economic growth.

We also need to improve the efficiency of government expenditures. We have decided to increase the consumption tax rate, which is important to sustain our social security services. I know that the current situation is difficult, and the world economy will have ups and downs. But that is the mandate I was given, and we are elbowing our way through.

It sometimes seems like there are two different Shinzo Abes: the nationalist or conservative Abe, who does controversial things, such as support history textbook revision, question the comfort women issue, or question the legitimacy of the Allied war crimes tribunal, and the pragmatic Abe, who reaches out to China and South Korea and who has been careful not to escalate tensions over the Senkaku Islands. In recent weeks, both have been on display: first, you seemed to question in the Diet whether Japan was the aggressor in World War II, and then, a week later, you acknowledged the suffering that Japan caused during the war. Which is the real Abe, and how should people interpret the shifts between the two?

As I said at the outset, I have had my remarks only partially or mistakenly quoted by the mainstream media. Let me set the record straight. Throughout my first and current terms as prime minister, I have expressed a number of times the deep remorse that I share for the tremendous damage and suffering Japan caused in the past to the people of many countries, particularly in Asia. I have explicitly said that, yet it made few headlines.

Do you accept that Japan was the aggressor when it invaded China, when it invaded Korea, and when it attacked the United States in World War II?

I have never said that Japan has not committed aggression. Yet at the same time, how best, or not, to define “aggression” is none of my business. That’s what historians ought to work on. I have been saying that our work is to discuss what kind of world we should create in the future.

It always seems to cause problems when you talk about history, so why not just avoid it? And let me ask a related question: In order to put these issues aside, can you promise that as prime minister, you will not visit Yasukuni Shrine in either your official or your private capacity?

I never raised the issue of history myself. During [recent] deliberations in the Diet, I faced questions from other members, and I had to answer them. When doing so, I kept saying that the issue is one for historians, since otherwise you could politicize it or turn it into a diplomatic issue.

About the Yasukuni Shrine, let me humbly urge you to think about your own place to pay homage to the war dead, Arlington National Cemetery, in the United States. The presidents of the United States go there, and as Japan’s prime minister, I have visited. Professor Kevin Doak of Georgetown University points out that visiting the cemetery does not mean endorsing slavery, even though Confederate soldiers are buried there. I am of a view that we can make a similar argument about Yasukuni, which enshrines the souls of those who lost their lives in the service of their country.

But with all due respect, there are 13 Class A war criminals buried at Yasukuni, which is why it makes China and South Korea crazy when Japanese prime ministers go there. Wouldn’t it be easier just to promise not to go?

I think it’s quite natural for a Japanese leader to offer prayer for those who sacrificed their lives for their country, and I think this is no different from what other world leaders do.

After Yasukuni enshrined the souls of the Class A criminals, China and South Korea did not make any claims about visits there for some years. Then suddenly, they started opposing the visits. So I will not say whether I will visit or refrain from visiting the shrine.

You said in January that there is no room for negotiation over the Senkaku Islands. If you take such an inflexible position and China takes such an inflexible position, there will be no progress. So what is the solution?

Seven years ago, as prime minister, I chose China as the first destination for an official visit. On that occasion, I agreed with the Chinese leaders that both countries would strive for a mutually beneficial relationship based on common strategic interests. I conveyed to the Chinese that Japan and China enjoy an inseparable relationship, especially in terms of economic ties. And I believe that it is wrong to close down all aspects of the bilateral relationship because of a single issue -- it would not be a smart move. That is why I always keep the door open for dialogue. I think China should come back to the starting point of the mutually beneficial relationship the two countries agreed on.

As for the Senkaku Islands, Japan incorporated them back in 1895, after taking measures in accordance with international law. And it was not until 1971 that China made its territorial claims over the islands. The Senkaku Islands are an integral part of Japanese territory, based on both history and international law. Only after keeping silent for 76 years, and after the United Nations referred to the possible existence of natural resources underneath the adjacent seabed, did China start making their territorial claims, rather abruptly.

Since 2008, the Chinese side has been dispatching official or naval vessels to intrude into Japanese territorial waters. The phenomenon is older and more deeply rooted than may meet the eye. There is no question that we have to address the issue in the most professional manner, and I have instructed the whole of my government to respond to the situation in the calmest manner possible. And we are [still] saying that we will always keep the door open for dialogue.

But what are you willing to do to resolve the problem? Cui Tiankai, the new Chinese ambassador to the United States, told me recently that the best thing would be to just ignore the sovereignty issue and return to the status quo where China and Japan agree to disagree.

That Chinese claim means Japan should admit that there exists an issue of territorial sovereignty to be resolved. We can never let this argument take place. The Chinese side has been using a similar argument against Vietnam and the Philippines to gain control over islands in the South China Sea. And recently, on May 8, China’s People’s Daily published an article questioning the status of Okinawa itself.

We have never agreed with the Chinese to shelve the issue of the Senkaku Islands. To say that we have in the past is a complete lie by the Chinese.

Given the rise of China and its more aggressive behavior, are you still confident in the U.S. security relationship, or do you feel that Japan needs to be doing more to protect itself? And is this why you’re interested in revising Japan’s constitution?

Of course, I have full confidence in the Japanese-U.S. alliance -- one hundred percent. After the Great East Japan Earthquake of 2011, the United States dispatched a total of 20,000 military personnel; even under difficult circumstances, the United States offered to cooperate in Japan’s reconstruction efforts. That is a true reflection of our relationship. And we fully welcome and happily support the strategic rebalancing by the United States toward Asia.

But at the same time, Japan is also willing to fulfill its responsibilities. Over the past ten years, my country has continued to cut its defense budget. China, on the other hand, has increased its military spending 30-fold in the last 23 years. Therefore, this year, for the first time in 11 years, my government chose to slightly increase the defense budget. That is a sign of Japan’s willingness to fulfill its own responsibility.

With regard to the issue of the right to collective self-defense, imagine that U.S. vessels on the high seas were being attacked and an armed ship, say an Aegis-type destroyer, from Japan, America’s treaty ally, was just passing by. The arrangement we currently have in Japan does not allow the destroyer to make any response whatsoever. That is insane.

So do you want to change Article 9 [the pacifist clause in Japan’s constitution] to address this?

To amend the constitution requires overcoming a high hurdle: we would have to get the approval of at least two-thirds of the members of the Japanese parliament and later a simple majority in a national referendum.

Yet the fact remains that Japan is the only country in the world that does not call its defense organizations a military. That is absurd, when the government is spending a total of 5 trillion yen [a year] for self-defense.

I think that our constitution should stipulate that our Self-Defense Forces are military forces (as it currently does not) and should also stipulate the long-established principles of civilian control and pacifism. Even if we reactivated the right to have a collective self-defense or amended Article 9 of the constitution, that would only put Japan in the same position as other countries around the globe. We should address this issue in a restrained manner. Even if we amended the constitution and were able to exercise the right to collective self-defense, we would still be in a more limited position than the Canadians.

So to be clear, do you want to change the constitution to make collective self-defense easier?

I would like to see the constitution amended, and my party has already published a draft proposal for the amendment of the constitution, including Article 9.

Why does the majority of the Japanese public still oppose constitutional revision?

More than 50 percent of Japanese nationals support the idea of changing the constitution [in general], while less than 50 percent support the amendment of Article 9. But polls also indicate that once told the rationale in more detail, they turn in favor of amendment.

So you think they just don’t understand the issue?

Only 30 percent of the people support enabling the right to use force for collective self-defense. But when we present a specific case involving, for instance, a missile launch by North Korea, and we explain to the public that Japan could shoot down missiles targeting Japan, but not missiles targeting the U.S. island of Guam, even though Japan has the ability to do so, then more than 60 percent of the public acknowledges that this is not right.

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 79

Re: The US Economy Thread

Re: The US Economy Thread

Japan is facing an extremely rapid decline in birthrates, and Japan’s national income has lost as much as 50 trillion yen due to prolonged deflation. Put those together, and you get a much smaller tax base. That is why we are facing a very difficult financial situation, and that was the core concern that led my government to launch the “three arrow” recovery plan

The bond repurchase and interest payments aside, the government’s current spending must meet its annual tax revenue. To achieve that balance remains our first priority, and we have made an international pledge to do so. By fiscal year 2015, we are going to halve our primary-balance deficit, and by 2020, we will achieve balance. To do so, we have to increase tax revenue. We also need to end the deflationary cycle. And we have to achieve economic growth.

Does anyone envy his job?

kiranr- First Team

- Club Supported :

Posts : 3496

Join date : 2011-06-06

Re: The US Economy Thread

Re: The US Economy Thread

Kyle bass

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 79

Re: The US Economy Thread

Re: The US Economy Thread

The Fed vs. Congress: Who Is Enabling Whom?

The dominant narrative about economic policy has it that the Federal Reserve's easy money policies are enabling congressional intransigence and partisanship. But this might be exactly backward.

Ironically, the story line is helped along by Ben Bernanke, who often appears to be scolding Congress for poor fiscal stewardship. The idea is that if Congress could "get its act together" then the Fed wouldn't need to provide "extraordinary" accommodative policies. This has crepted into the statements of the Federal Open Market Committee, which has stated point blank that "fiscal policy is restraining economic growth."

But if you squint hard enough, you can see this as an attempt at policy shirking. The Fed would like Congress to take responsibility for economic policy through fiscal accommodation—that is, bigger short-term deficits—which would allow the Fed to back off from monetary accommodation.

Which is to say, the Fed would like to ease up on monetary accommodation but fears that Congress seems unlikely to implement fiscal policy that won't restrain growth. To put it differently, if Congress were to "get its act together" and provide fiscal relief to the economy, the Fed likely would respond by tightening.

That means that the dominant narrative may have things backward. Instead of Fed policy enabling congressional bungling, it's Congress that is enabling Fed policy. A Congress that was less divided along partisan lines and dedicated to stimulating the economy might trigger a tightening reaction by the Fed.

That's what Scott Sumner, the word's most famous expounder of the nominal-growth targeting Market Monetarist school of economics, seems to be saying in his recent post.

Shorter Sumner: Fiscal stimulus would crowd out monetary stimulus.

Would this be a good thing or a bad thing? The answer depends on whether you think an accommodative monetary policy or an accommodative fiscal policy would be more effective at strengthening the economy.

It's important to note here that we're not talking about anything mechanical. Higher levels of deficit spending do not automatically "push up interest rates." The Fed sets short term rates, and long term rates follow the expected path of short term rates. Rates rise and monetary policy tightens either because the Fed sets rates higher or the market expects to set rates higher.

This means that the tightening predicted by Sumner happens only if the Fed wants it to happen or if the market believes the Fed will react that way. A Fed that believes greater fiscal stimulus should accompany accommodative monetary policy in our current economic situation could make it clear that it won't raise rates in reaction to looser fiscal policy.

It's noteworthy that this is not what the Fed has been doing. Instead, the statements from Bernanke and the FOMC imply the opposite: that monetary policy remains accommodative because fiscal policy is restraining growth. The corollary of this is that if fiscal policy stopped being a drag, monetary policy would tighten. So the Fed itself seems to be saying that it would tighten policy if fiscal policy became more stimulative.

This brings us right back to what is actually the most important economic question of our time: Would fiscal accommodation be more effective than monetary accommodation?

A related question that must also be asked in this context: Which set of policies creates the greatest economic risk? Fiscal accommodation runs the risk of ever-growing deficits since new spending is notoriously hard to pare back and tax cuts difficult to reverse. Recently, however, we seemed to have developed the political technology to overcome this through automatic sequester. Monetary accommodation runs the risk of high inflation—but that risk seems far smaller than most people believed just a few years ago.

There's a final position that should be considered here—that of Richard Fisher, president of the Dallas Fed. Fisher recently argued that the reason fiscal policy has been restraining growth is not that it is too tight. Rather, he said in a speech to the National Association for Business Economics on May 16, that a regulatory regime that is too burdensome combined with the lack of a roadmap to "fiscal rectitude" is what is restraining growth and limiting the effectiveness of monetary policy. Fear of higher health care costs, inflation, compliance costs and taxes is the problem, Fisher argued.

Because of this four-part cocktail of fear and uncertainty, both monetary and fiscal policy have become ineffective, according to Fisher.

"Even if the arguments of those who wish for greater fiscal stimulus prevail, expansion in government purchases will have reduced effectiveness if it is thought that those purchases will be financed with higher future marginal tax rates," Fisher said.

This raises the question of congressional credibility. Monetary policy wonks often debate whether the Fed can credibly commit to higher growth policies without risking its credibility on containing inflation. If Fisher is right, the more appropriate question is whether Congress and the president can do this? Is there anyway Congress can reassure market actors that it won't let health care costs, regulatory compliance costs, and taxes rise without engaging in so much deficit spending that inflation becomes a primary concern?

If you're feeling cynical about Congress right now, the monetarist position is perhaps the only one offering real hope. If monetary policy works and will remain accommodative so long as Congress remains stalled on fiscal policy, monetarism offers a glimmer of hope for future growth.

Which brings us back to the dominant narrative and a warning about its possible destructiveness. If the Fed becomes convinced that monetary accommodation is "enabling" fiscal irresponsibility, some Fed policymakers could become convinced that they need to tighten to spur fiscal action. If that worked—and fiscal policy is effective—huzzah! But if it failed—if the Fed tightened while fiscal policy remained stalled—we could witness the greatest economic miscalculation since the Great Depression.

http://www.cnbc.com/id/100770053

The dominant narrative about economic policy has it that the Federal Reserve's easy money policies are enabling congressional intransigence and partisanship. But this might be exactly backward.

Ironically, the story line is helped along by Ben Bernanke, who often appears to be scolding Congress for poor fiscal stewardship. The idea is that if Congress could "get its act together" then the Fed wouldn't need to provide "extraordinary" accommodative policies. This has crepted into the statements of the Federal Open Market Committee, which has stated point blank that "fiscal policy is restraining economic growth."

But if you squint hard enough, you can see this as an attempt at policy shirking. The Fed would like Congress to take responsibility for economic policy through fiscal accommodation—that is, bigger short-term deficits—which would allow the Fed to back off from monetary accommodation.

Which is to say, the Fed would like to ease up on monetary accommodation but fears that Congress seems unlikely to implement fiscal policy that won't restrain growth. To put it differently, if Congress were to "get its act together" and provide fiscal relief to the economy, the Fed likely would respond by tightening.

That means that the dominant narrative may have things backward. Instead of Fed policy enabling congressional bungling, it's Congress that is enabling Fed policy. A Congress that was less divided along partisan lines and dedicated to stimulating the economy might trigger a tightening reaction by the Fed.

That's what Scott Sumner, the word's most famous expounder of the nominal-growth targeting Market Monetarist school of economics, seems to be saying in his recent post.

Despite the current round of austerity, growth this year (partly due to QE3) is so strong that the Fed is considering tightening monetary policy. Now let me emphasize that I don't think growth is very strong this year, and I oppose tightening monetary policy. But it doesn't matter what I think, and I'm not even sure it matters what Bernanke thinks. It matters what the Fed thinks. And if they are strongly considering tightening monetary policy under current conditions, just imagine what they'd be doing if Congress was actually doing fiscal stimulus right now!

Shorter Sumner: Fiscal stimulus would crowd out monetary stimulus.

Would this be a good thing or a bad thing? The answer depends on whether you think an accommodative monetary policy or an accommodative fiscal policy would be more effective at strengthening the economy.

It's important to note here that we're not talking about anything mechanical. Higher levels of deficit spending do not automatically "push up interest rates." The Fed sets short term rates, and long term rates follow the expected path of short term rates. Rates rise and monetary policy tightens either because the Fed sets rates higher or the market expects to set rates higher.

This means that the tightening predicted by Sumner happens only if the Fed wants it to happen or if the market believes the Fed will react that way. A Fed that believes greater fiscal stimulus should accompany accommodative monetary policy in our current economic situation could make it clear that it won't raise rates in reaction to looser fiscal policy.

It's noteworthy that this is not what the Fed has been doing. Instead, the statements from Bernanke and the FOMC imply the opposite: that monetary policy remains accommodative because fiscal policy is restraining growth. The corollary of this is that if fiscal policy stopped being a drag, monetary policy would tighten. So the Fed itself seems to be saying that it would tighten policy if fiscal policy became more stimulative.

This brings us right back to what is actually the most important economic question of our time: Would fiscal accommodation be more effective than monetary accommodation?

A related question that must also be asked in this context: Which set of policies creates the greatest economic risk? Fiscal accommodation runs the risk of ever-growing deficits since new spending is notoriously hard to pare back and tax cuts difficult to reverse. Recently, however, we seemed to have developed the political technology to overcome this through automatic sequester. Monetary accommodation runs the risk of high inflation—but that risk seems far smaller than most people believed just a few years ago.

There's a final position that should be considered here—that of Richard Fisher, president of the Dallas Fed. Fisher recently argued that the reason fiscal policy has been restraining growth is not that it is too tight. Rather, he said in a speech to the National Association for Business Economics on May 16, that a regulatory regime that is too burdensome combined with the lack of a roadmap to "fiscal rectitude" is what is restraining growth and limiting the effectiveness of monetary policy. Fear of higher health care costs, inflation, compliance costs and taxes is the problem, Fisher argued.

Because of this four-part cocktail of fear and uncertainty, both monetary and fiscal policy have become ineffective, according to Fisher.

"Even if the arguments of those who wish for greater fiscal stimulus prevail, expansion in government purchases will have reduced effectiveness if it is thought that those purchases will be financed with higher future marginal tax rates," Fisher said.

This raises the question of congressional credibility. Monetary policy wonks often debate whether the Fed can credibly commit to higher growth policies without risking its credibility on containing inflation. If Fisher is right, the more appropriate question is whether Congress and the president can do this? Is there anyway Congress can reassure market actors that it won't let health care costs, regulatory compliance costs, and taxes rise without engaging in so much deficit spending that inflation becomes a primary concern?

If you're feeling cynical about Congress right now, the monetarist position is perhaps the only one offering real hope. If monetary policy works and will remain accommodative so long as Congress remains stalled on fiscal policy, monetarism offers a glimmer of hope for future growth.

Which brings us back to the dominant narrative and a warning about its possible destructiveness. If the Fed becomes convinced that monetary accommodation is "enabling" fiscal irresponsibility, some Fed policymakers could become convinced that they need to tighten to spur fiscal action. If that worked—and fiscal policy is effective—huzzah! But if it failed—if the Fed tightened while fiscal policy remained stalled—we could witness the greatest economic miscalculation since the Great Depression.

http://www.cnbc.com/id/100770053

BarrileteCosmico- Admin

- Club Supported :

Posts : 28386

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

Paul Krugman Arrested For Urinating on Teddy Bear

Economist Paul Krugman was arrested today for urinating on a teddy bear belonging to the 6-year-old daughter of rival economist Kenneth Rogoff.

According to police in Cambridge, Mass., Krugman stole the bear from a window sill at the Rogoff family home and was relieving himself on it when a passing police officer caught him.

Krugman had intended to return the pee-soaked bear to the window sill as part of a long running feud with Rogoff and his collaborator Carmen Reinhart over the merits of austerity.

According to witnesses the Nobel Prize winning trade economist resisted arrest and was shouting pro-Keynesian slogans to the officer and the onlookers.

"This motherf****r said output growth slowed when public debt rose above 90 percent of GDP, but he was f*****g wrong," Krugman told the police officer, "and you're arresting me? This little bitch falsifies his data, and somehow I'm the f*****g criminal?"

Behavioral Economics

Krugman has a long running feud with Rogoff and Reinhart, who in 2010 co-authored a paper which argued that excessive government debt slowed economic growth. That paper has since been found to contain numerous factual and methodological errors, and Krugman has not missed an opportunity to publicly blast his rivals' mistakes.

The disagreement took a new turn last weekend when the Harvard duo called Krugman out for his highly negative and personal attacks, deeming it "spectacularly uncivil behavior." Rather than back down, however, Krugman escalated the dispute by flying to Boston and bringing the fight to Rogoff's doorstep.

"This isn't sociology, this is economics," Krugman explained in an exclusive interview from the Middlesex County jail. "Economics is a motherf*****g war, and I'm a motherf*****g soldier.

"If this little coward didn't want his daughter's teddy bear involved in this s**t, then maybe he should have thought twice before he published a study that called into question my own personal beliefs about the relationship between public debt and growth."

Krugman is expected to be charged with public urination for the bear incident and defacement of private property for spray-painting the equation "AD = C + I + G + (X-M)" on Rogoff's garage door.

For her part, young Lindsey Rogoff says it will be hard to find a replacement for the teddy bear she called Samantha.

"It was my most favorite stuffed animal," she says. "Daddy said he was sorry. I don't know why Mr. Krugman has to be so mean."

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 79

Re: The US Economy Thread

Re: The US Economy Thread

Wouldn't be surprised to find out that was true

BarrileteCosmico- Admin

- Club Supported :

Posts : 28386

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

David Beckworth explaining why the Fed does not set interest rates:

http://www.nationalreview.com/article/349636/low-interest-rate-blues-david-beckworth

http://www.nationalreview.com/article/349636/low-interest-rate-blues-david-beckworth

BarrileteCosmico- Admin

- Club Supported :

Posts : 28386

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

Ben speaks at princeton, dropping some gems on the graduating class

It's nice to be back at Princeton. I find it difficult to believe that it's been almost 11 years since I departed these halls for Washington. I wrote recently to inquire about the status of my leave from the university, and the letter I got back began, "Regrettably, Princeton receives many more qualified applicants for faculty positions than we can accommodate."1

I'll extend my best wishes to the seniors later, but first I want to congratulate the parents and families here. As a parent myself, I know that putting your kid through college these days is no walk in the park. Some years ago I had a colleague who sent three kids through Princeton even though neither he nor his wife attended this university. He and his spouse were very proud of that accomplishment, as they should have been. But my colleague also used to say that, from a financial perspective, the experience was like buying a new Cadillac every year and then driving it off a cliff. I should say that he always added that he would do it all over again in a minute. So, well done, moms, dads, and families.

This is indeed an impressive and appropriate setting for a commencement. I am sure that, from this lectern, any number of distinguished spiritual leaders have ruminated on the lessons of the Ten Commandments. I don't have that kind of confidence, and, anyway, coveting your neighbor's ox or donkey is not the problem it used to be, so I thought I would use my few minutes today to make Ten Suggestions, or maybe just Ten Observations, about the world and your lives after Princeton. Please note, these points have nothing whatsoever to do with interest rates. My qualification for making such suggestions, or observations, besides having kindly been invited to speak today by President Tilghman, is the same as the reason that your obnoxious brother or sister got to go to bed later--I am older than you. All of what follows has been road-tested in real-life situations, but past performance is no guarantee of future results.

1. The poet Robert Burns once said something about the best-laid plans of mice and men ganging aft agley, whatever "agley" means. A more contemporary philosopher, Forrest Gump, said something similar about life and boxes of chocolates and not knowing what you are going to get. They were both right. Life is amazingly unpredictable; any 22-year-old who thinks he or she knows where they will be in 10 years, much less in 30, is simply lacking imagination. Look what happened to me: A dozen years ago I was minding my own business teaching Economics 101 in Alexander Hall and trying to think of good excuses for avoiding faculty meetings. Then I got a phone call . . . In case you are skeptical of Forrest Gump's insight, here's a concrete suggestion for each of the graduating seniors. Take a few minutes the first chance you get and talk to an alum participating in his or her 25th, or 30th, or 40th reunion--you know, somebody who was near the front of the P-rade. Ask them, back when they were graduating 25, 30, or 40 years ago, where they expected to be today. If you can get them to open up, they will tell you that today they are happy and satisfied in various measures, or not, and their personal stories will be filled with highs and lows and in-betweens. But, I am willing to bet, those life stories will in almost all cases be quite different, in large and small ways, from what they expected when they started out. This is a good thing, not a bad thing; who wants to know the end of a story that's only in its early chapters? Don't be afraid to let the drama play out.

2. Does the fact that our lives are so influenced by chance and seemingly small decisions and actions mean that there is no point to planning, to striving? Not at all. Whatever life may have in store for you, each of you has a grand, lifelong project, and that is the development of yourself as a human being. Your family and friends and your time at Princeton have given you a good start. What will you do with it? Will you keep learning and thinking hard and critically about the most important questions? Will you become an emotionally stronger person, more generous, more loving, more ethical? Will you involve yourself actively and constructively in the world? Many things will happen in your lives, pleasant and not so pleasant, but, paraphrasing a Woodrow Wilson School adage from the time I was here, "Wherever you go, there you are." If you are not happy with yourself, even the loftiest achievements won't bring you much satisfaction.

3. The concept of success leads me to consider so-called meritocracies and their implications. We have been taught that meritocratic institutions and societies are fair. Putting aside the reality that no system, including our own, is really entirely meritocratic, meritocracies may be fairer and more efficient than some alternatives. But fair in an absolute sense? Think about it. A meritocracy is a system in which the people who are the luckiest in their health and genetic endowment; luckiest in terms of family support, encouragement, and, probably, income; luckiest in their educational and career opportunities; and luckiest in so many other ways difficult to enumerate--these are the folks who reap the largest rewards. The only way for even a putative meritocracy to hope to pass ethical muster, to be considered fair, is if those who are the luckiest in all of those respects also have the greatest responsibility to work hard, to contribute to the betterment of the world, and to share their luck with others. As the Gospel of Luke says (and I am sure my rabbi will forgive me for quoting the New Testament in a good cause): "From everyone to whom much has been given, much will be required; and from the one to whom much has been entrusted, even more will be demanded" (Luke 12:48, New Revised Standard Version Bible). Kind of grading on the curve, you might say.

4. Who is worthy of admiration? The admonition from Luke--which is shared by most ethical and philosophical traditions, by the way--helps with this question as well. Those most worthy of admiration are those who have made the best use of their advantages or, alternatively, coped most courageously with their adversities. I think most of us would agree that people who have, say, little formal schooling but labor honestly and diligently to help feed, clothe, and educate their families are deserving of greater respect--and help, if necessary--than many people who are superficially more successful. They're more fun to have a beer with, too. That's all that I know about sociology.

5. Since I have covered what I know about sociology, I might as well say something about political science as well. In regard to politics, I have always liked Lily Tomlin's line, in paraphrase: "I try to be cynical, but I just can't keep up." We all feel that way sometime. Actually, having been in Washington now for almost 11 years, as I mentioned, I feel that way quite a bit. Ultimately, though, cynicism is a poor substitute for critical thought and constructive action. Sure, interests and money and ideology all matter, as you learned in political science. But my experience is that most of our politicians and policymakers are trying to do the right thing, according to their own views and consciences, most of the time. If you think that the bad or indifferent results that too often come out of Washington are due to base motives and bad intentions, you are giving politicians and policymakers way too much credit for being effective. Honest error in the face of complex and possibly intractable problems is a far more important source of bad results than are bad motives. For these reasons, the greatest forces in Washington are ideas, and people prepared to act on those ideas. Public service isn't easy. But, in the end, if you are inclined in that direction, it is a worthy and challenging pursuit.

6. Having taken a stab at sociology and political science, let me wrap up economics while I'm at it. Economics is a highly sophisticated field of thought that is superb at explaining to policymakers precisely why the choices they made in the past were wrong. About the future, not so much. However, careful economic analysis does have one important benefit, which is that it can help kill ideas that are completely logically inconsistent or wildly at variance with the data. This insight covers at least 90 percent of proposed economic policies.

7. I'm not going to tell you that money doesn't matter, because you wouldn't believe me anyway. In fact, for too many people around the world, money is literally a life-or-death proposition. But if you are part of the lucky minority with the ability to choose, remember that money is a means, not an end. A career decision based only on money and not on love of the work or a desire to make a difference is a recipe for unhappiness.

8. Nobody likes to fail but failure is an essential part of life and of learning. If your uniform isn't dirty, you haven't been in the game.

9. I spoke earlier about definitions of personal success in an unpredictable world. I hope that as you develop your own definition of success, you will be able to do so, if you wish, with a close companion on your journey. In making that choice, remember that physical beauty is evolution's way of assuring us that the other person doesn't have too many intestinal parasites. Don't get me wrong, I am all for beauty, romance, and sexual attraction--where would Hollywood and Madison Avenue be without them? But while important, those are not the only things to look for in a partner. The two of you will have a long trip together, I hope, and you will need each other's support and sympathy more times than you can count. Speaking as somebody who has been happily married for 35 years, I can't imagine any choice more consequential for a lifelong journey than the choice of a traveling companion.

10. Call your mom and dad once in a while. A time will come when you will want your own grown-up, busy, hyper-successful children to call you. Also, remember who paid your tuition to Princeton.

Those are my suggestions. They're probably worth exactly what you paid for them. But they come from someone who shares your affection for this great institution and who wishes you the best for the future.

Congratulations, graduates. Give 'em hell.

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 79

Re: The US Economy Thread

Re: The US Economy Thread

market drops 3.5% in 2 days due to QE ending talk

zizzle- Fan Favorite

- Club Supported :

Posts : 6887

Join date : 2011-06-05

Age : 104

Re: The US Economy Thread

Re: The US Economy Thread

Fantastic article on copying in Developing economies

m.foreignaffairs.com/articles/139452/kal-raustiala-and-christopher-sprigman/fake-it-till-you-make-it

m.foreignaffairs.com/articles/139452/kal-raustiala-and-christopher-sprigman/fake-it-till-you-make-it

BarrileteCosmico- Admin

- Club Supported :

Posts : 28386

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

can anyone give me an abenomics/japan/boj update?

been too busy with work and haven't gotten a chance to check whats going on

been too busy with work and haven't gotten a chance to check whats going on

Swanhends- Fan Favorite

- Club Supported :

Posts : 8451

Join date : 2011-06-05

Re: The US Economy Thread

Re: The US Economy Thread

Bhends:

http://ftalphaville.ft.com/2013/06/28/1550382/advantage-abe/

The first bits of post-Abenomics data are finally trickling in. And so far, it has to be said, it’s looking good for Shinzo Abe.

Lombard Street Research’s Michael Taylor takes us through the initial findings (our emphasis):

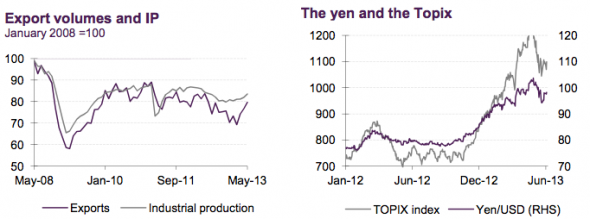

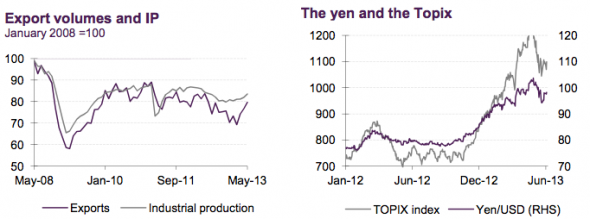

A recovery in industrial production and consumer spending points to above-trend growth in Q2. Consumer price inflation may soon make a brief appearance above zero on the back of higher energy and import prices. But deflation isn’t beaten yet. The splurge of Japanese data overnight confirms the overall positive trend in the economy. Notably, industrial production increased by 2% in the month of May, the fourth consecutive monthly increase. Output in May was boosted by electronic components and machinery in particular. Both industrial production and exports are now on an upward trend (see chart below). To a large extent this recovery is due to the weaker yen. Although the yen is above its recent lows against the US dollar, it is still 19% lower than last November.

As for inflation and consumer spending:

As the chart (above right) shows, the fall in the yen has coincided with an equity market rally. This, plus an increase in inflation expectations triggered by aggressive monetary ease from the Bank of Japan, is also helping to boost consumer spending. For May household spending data show a 0.1% monthly gain, while retail trade data were up by 1.5%. Both are on an upward trend and will support another quarter of fairly robust GDP growth in Q2. Meanwhile headline CPI inflation was -0.3% in May, up from -0.7% in April.

Higher energy prices are contributing to less deflation. Electricity prices are up 8.7% over the last 12 months, the fastest rate in over 30 years. Higher import prices as a consequence of the weaker yen may push national CPI inflation slightly above zero in coming months. But of course this would not herald the end of deflation as underlying pressures remain deflationary.

Meanwhile, Nomura suggests that on the back of this data core inflation of positive 0.4 per cent might even be possible in June:

May core CPI, which excludes fresh foods, recorded +0.0% y-o-y, accelerating from -0.4% y-o-y in April. June Tokyo core CPI inched up to +0.2% y-o-y from +0.1% y-o-y. Partly thanks to a decline in prices from April to June last year, we think core CPI inflation is likely to rise further in June, recording positive inflation. Our economists think +0.4% core inflation in June is possible, the highest inflation since November 2008 (see “June all-Japan core CPI may come in at +0.4%”, 28 June 2013). Even though the expected spike in June comes partly from technical factors, +0.4% y-o-y inflation could positively influence inflation expectations.

Though, the lingering question remains, at what cost has all this come? And to what degree is it Japan that rumbled everything else in the market?

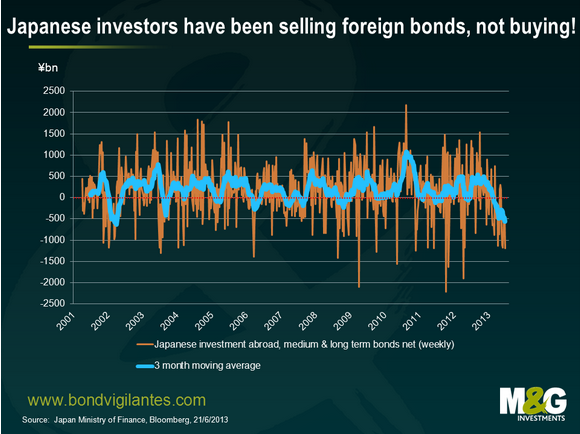

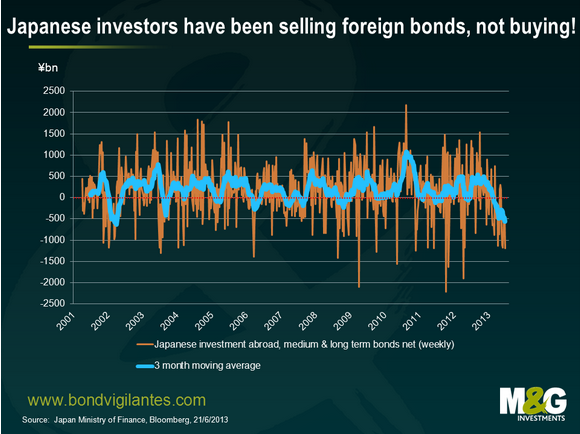

One chart worth reiterating on that front is the following, courtesy of Bond Vigilantes:

And as Reuters noted on Thursday:

Japanese investors’ net selling of foreign bonds hit its highest level in 14 months last week as they continued to defy expectations Japan’s radical monetary policy to reflate its economy would lead to a flight of investment out of the country.

Meaning very loosely that Japan’s gain is increasingly the rest of the world’s loss

http://ftalphaville.ft.com/2013/06/28/1550382/advantage-abe/

The first bits of post-Abenomics data are finally trickling in. And so far, it has to be said, it’s looking good for Shinzo Abe.

Lombard Street Research’s Michael Taylor takes us through the initial findings (our emphasis):

A recovery in industrial production and consumer spending points to above-trend growth in Q2. Consumer price inflation may soon make a brief appearance above zero on the back of higher energy and import prices. But deflation isn’t beaten yet. The splurge of Japanese data overnight confirms the overall positive trend in the economy. Notably, industrial production increased by 2% in the month of May, the fourth consecutive monthly increase. Output in May was boosted by electronic components and machinery in particular. Both industrial production and exports are now on an upward trend (see chart below). To a large extent this recovery is due to the weaker yen. Although the yen is above its recent lows against the US dollar, it is still 19% lower than last November.

As for inflation and consumer spending:

As the chart (above right) shows, the fall in the yen has coincided with an equity market rally. This, plus an increase in inflation expectations triggered by aggressive monetary ease from the Bank of Japan, is also helping to boost consumer spending. For May household spending data show a 0.1% monthly gain, while retail trade data were up by 1.5%. Both are on an upward trend and will support another quarter of fairly robust GDP growth in Q2. Meanwhile headline CPI inflation was -0.3% in May, up from -0.7% in April.

Higher energy prices are contributing to less deflation. Electricity prices are up 8.7% over the last 12 months, the fastest rate in over 30 years. Higher import prices as a consequence of the weaker yen may push national CPI inflation slightly above zero in coming months. But of course this would not herald the end of deflation as underlying pressures remain deflationary.

Meanwhile, Nomura suggests that on the back of this data core inflation of positive 0.4 per cent might even be possible in June:

May core CPI, which excludes fresh foods, recorded +0.0% y-o-y, accelerating from -0.4% y-o-y in April. June Tokyo core CPI inched up to +0.2% y-o-y from +0.1% y-o-y. Partly thanks to a decline in prices from April to June last year, we think core CPI inflation is likely to rise further in June, recording positive inflation. Our economists think +0.4% core inflation in June is possible, the highest inflation since November 2008 (see “June all-Japan core CPI may come in at +0.4%”, 28 June 2013). Even though the expected spike in June comes partly from technical factors, +0.4% y-o-y inflation could positively influence inflation expectations.

Though, the lingering question remains, at what cost has all this come? And to what degree is it Japan that rumbled everything else in the market?

One chart worth reiterating on that front is the following, courtesy of Bond Vigilantes:

And as Reuters noted on Thursday:

Japanese investors’ net selling of foreign bonds hit its highest level in 14 months last week as they continued to defy expectations Japan’s radical monetary policy to reflate its economy would lead to a flight of investment out of the country.

Meaning very loosely that Japan’s gain is increasingly the rest of the world’s loss

Last edited by BarrileteCosmico on Mon Jul 01, 2013 9:31 pm; edited 1 time in total

BarrileteCosmico- Admin

- Club Supported :

Posts : 28386

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

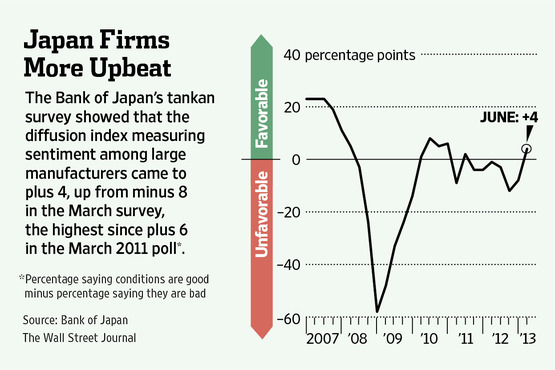

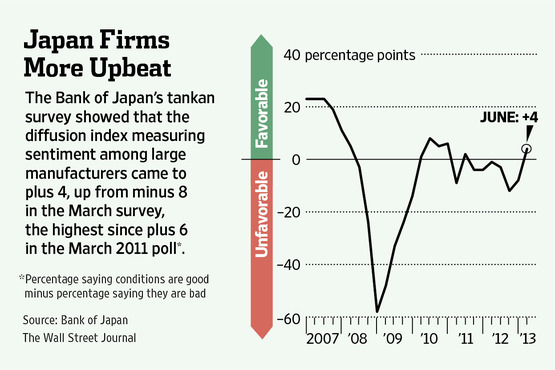

http://blogs.wsj.com/japanrealtime/2013/07/01/boj-beat-five-takeaways-from-japans-tankan-business-sentiment-survey/

The Bank of Japan’s closely-watched tankan survey of corporate sentiment showed that the mood among businesses improved sharply in the three months to June after the central bank introduced an aggressive easing policy in April. Here are five initial takeaways from the poll.

The best reading in two years. The headline figure measuring sentiment among large manufacturers came to plus 4, up from minus 8 in the March survey. That’s the highest since plus 6 in the March 2011 poll, and the first positive reading following six straight quarters of minuses. The index of large non-manufacturers’ sentiment also improved to plus 12 in the latest tankan, up from plus 6 in the March survey, and the highest reading since March 2008. The index is calculated by subtracting the percentage of firms saying business conditions are bad from those saying they are good.

Stronger capex this fiscal year. The survey also showed that businesses were willing to spend on investment going forward. Big manufacturers and non-manufacturers revised higher their combined business investment plans for the current fiscal year started April to a 5.5% on-year rise from the 2.0% drop they had predicted in the March tankan.

First report card for Kuroda. BOJ Gov. Haruhiko Kuroda is likely to breathe a sigh of relief looking at the results of the survey, the first conducted after he led the central bank to introduce an easing policy on a “different dimension” in April, in a bid to beat deflation and generate 2% inflation in two years.

More good news for Abe. The tankan results are the latest in a series of indicators suggesting that Japan’s economy is continuing to pick up on recovering exports, despite the recent sharp pullback in Tokyo stock markets. That’s good news for Prime Minister Shinzo Abe, whose platform is based on putting the economy first with a policy mix of aggressive monetary easing, fiscal stimulus and pro-growth measures. He is enjoying strong support of around 60% ahead of an upper house election on July 21.

No policy change seen. The BOJ’s policy board meets next week. The tankan results were in line with expectations– economists polled by Dow Jones Newswires had expected a plus 4 reading for the main big manufacturers’ DI index—and reaffirms the majority view of the board that the economy is rebounding and that prices would start rising soon. As such, the BOJ is likely to stand pat on policy.

The Bank of Japan’s closely-watched tankan survey of corporate sentiment showed that the mood among businesses improved sharply in the three months to June after the central bank introduced an aggressive easing policy in April. Here are five initial takeaways from the poll.

The best reading in two years. The headline figure measuring sentiment among large manufacturers came to plus 4, up from minus 8 in the March survey. That’s the highest since plus 6 in the March 2011 poll, and the first positive reading following six straight quarters of minuses. The index of large non-manufacturers’ sentiment also improved to plus 12 in the latest tankan, up from plus 6 in the March survey, and the highest reading since March 2008. The index is calculated by subtracting the percentage of firms saying business conditions are bad from those saying they are good.

Stronger capex this fiscal year. The survey also showed that businesses were willing to spend on investment going forward. Big manufacturers and non-manufacturers revised higher their combined business investment plans for the current fiscal year started April to a 5.5% on-year rise from the 2.0% drop they had predicted in the March tankan.

First report card for Kuroda. BOJ Gov. Haruhiko Kuroda is likely to breathe a sigh of relief looking at the results of the survey, the first conducted after he led the central bank to introduce an easing policy on a “different dimension” in April, in a bid to beat deflation and generate 2% inflation in two years.

More good news for Abe. The tankan results are the latest in a series of indicators suggesting that Japan’s economy is continuing to pick up on recovering exports, despite the recent sharp pullback in Tokyo stock markets. That’s good news for Prime Minister Shinzo Abe, whose platform is based on putting the economy first with a policy mix of aggressive monetary easing, fiscal stimulus and pro-growth measures. He is enjoying strong support of around 60% ahead of an upper house election on July 21.

No policy change seen. The BOJ’s policy board meets next week. The tankan results were in line with expectations– economists polled by Dow Jones Newswires had expected a plus 4 reading for the main big manufacturers’ DI index—and reaffirms the majority view of the board that the economy is rebounding and that prices would start rising soon. As such, the BOJ is likely to stand pat on policy.

BarrileteCosmico- Admin

- Club Supported :

Posts : 28386

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

S&P 500 records fresh highs 07.11.2013

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 79

Re: The US Economy Thread

Re: The US Economy Thread

Thanks to Bernanke reassuring the market yesterday that the cheap money supply will continue

zizzle- Fan Favorite

- Club Supported :

Posts : 6887

Join date : 2011-06-05

Age : 104

Re: The US Economy Thread

Re: The US Economy Thread

zizzle wrote:Thanks to Bernanke reassuring the market yesterday that the cheap money supply will continue

The federal government is in the money again, at least it was for a few weeks.

For June, the U.S. Treasury Department reported a $117 billion surplus on Thursday, thanks to a continued uptick in revenue and a decline in spending

Another big boon to June's bottom line was a one-time $59 billion payment from Fannie Mae (FNMA, Fortune 500), according to the Congressional Budget Office. The government bailed out Fannie during the housing crisis.

June marks the fifth month since October 2011 that the government has recorded a monthly surplus.

There still, however, is a deficit of $510 billion for the first nine months of this fiscal year, which ends Sept. 30.

But that's well below the $904 billion deficit that had accumulated for the same period a year earlier.

In terms of revenue, $287 billion flowed into federal coffers in June, about 10% more than last June.

Individual income tax and payroll tax receipts were up, as were corporate income taxes.

Monthly spending, meanwhile, came in at $170 billion, nearly half the $320 billion in outlays in June 2012.

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 79

Re: The US Economy Thread

Re: The US Economy Thread

Call me a glass half empty kind of guy, but they're not records in real terms.

BarrileteCosmico- Admin

- Club Supported :

Posts : 28386

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

Almost related (and funny as hell regardless):

- Only for those with a sense of humour:

- U.S. Stock Market Soars After Bernanke’s Reassuring Comments About ‘Pacific Rim’

'The Giant Monsters And Robots Look ****ing Amazing,’ Says Fed Chief

WASHINGTON—The U.S. stock market soared to record highs Thursday with the Dow industrial average rallying 144 points after Federal Reserve Chairman Ben Bernanke’s reassuring remarks that the gigantic monsters and robots in the summer blockbuster Pacific Rim looked “super ****ing cool.” “I’m quite optimistic that for the foreseeable future, no other movie will even come close to topping the killer ****ing battle scenes between those badass robots and crazy sea monster things,” said Bernanke, who guaranteed that investors would not be wasting their money on the upcoming Guillermo del Toro action film, claiming that the awesome CGI effects were totally worth paying “three extra measly bucks to see it in 3D.” “Have you seen the Hellboy movies? That guy comes up with totally crazy creatures. And you actually get to see goddamn robots, unlike those lame-ass Transformers movies. So much shit gets destroyed. Just a great popcorn flick.” At press time, Wall Street continued to have unprecedented gains after Bernanke announced that the film’s star, Charlie Hunnam, “has ‘Next Big Thing’ written all over him.”

http://www.theonion.com/articles/us-stock-market-soars-after-bernankes-reassuring-c,33088/

RedOranje- Admin

- Club Supported :

Posts : 11099

Join date : 2011-06-05

Re: The US Economy Thread

Re: The US Economy Thread

BarrileteCosmico wrote:Call me a glass half empty kind of guy, but they're not records in real terms.

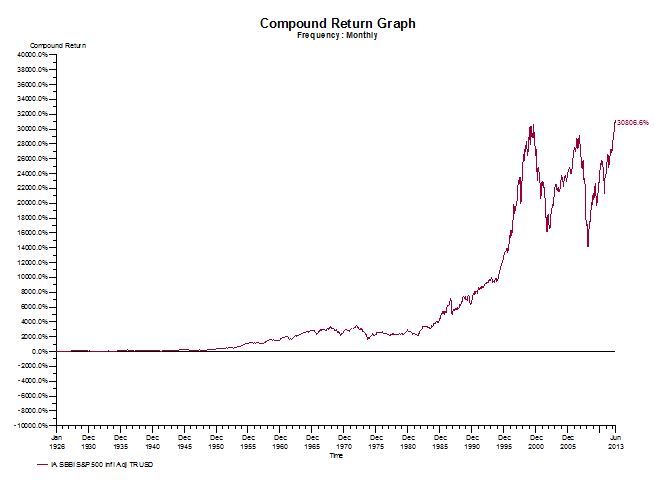

S&P 500 Breaks Inflation Adjusted All-Time High

It's official - the S&P 500, adjusted for inflation, has taken out an all-time high as of the end of June, on a total return basis.

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 79

Re: The US Economy Thread

Re: The US Economy Thread

Somehow I missed the news. That's pretty cool.

BarrileteCosmico- Admin

- Club Supported :

Posts : 28386

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

So who do you guys want as the next Fed Chairman?

Also in the Japan news they've hit 0.5% inflation (a record in a few years) but employers are reluctant to adjust wages.

Also in the Japan news they've hit 0.5% inflation (a record in a few years) but employers are reluctant to adjust wages.

BarrileteCosmico- Admin

- Club Supported :

Posts : 28386

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

BarrileteCosmico wrote:So who do you guys want as the next Fed Chairman?

Also in the Japan news they've hit 0.5% inflation (a record in a few years) but employers are reluctant to adjust wages.

I am firmly behind yellen to be honest, she is the perfect candidate for this time and age. Had good judgement with greenspan and bernanke, while being the architect of recent positive changes.

0.5% without wage inflation is great and bad at the same time, great cuz it means if there is wage inflation we should easily get up to 2.0% but if not then this whole thing could crash. I cant follow Japan too much right now just because emerging markets seems like where its at. We have countries crashing and burning and we will have much more of that when tapering begins, it should be very interesting in three or four months when that happens.

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 79

Page 4 of 8 •  1, 2, 3, 4, 5, 6, 7, 8

1, 2, 3, 4, 5, 6, 7, 8

Similar topics

Similar topics» Trump doing better in economy and job creation than " 2% growth is the new norm Obama"

» OFFICIAL THREAD -Juve - X [ MATCH THREAD,NEWS,LINEUPS,MATCHES, PRE-SEASON ]

» Official "I want to hit Neil Lennon" Thread. A.K.A Juve - Celtic game thread.

» The Rage thread Pt 2(AKA lets go for CL and Copa and forget about liga thread)

» Is this the best birthday ever? (AKA the Thank You Serbia Thread AKA I am a Happy Chilean Thread)

» OFFICIAL THREAD -Juve - X [ MATCH THREAD,NEWS,LINEUPS,MATCHES, PRE-SEASON ]

» Official "I want to hit Neil Lennon" Thread. A.K.A Juve - Celtic game thread.

» The Rage thread Pt 2(AKA lets go for CL and Copa and forget about liga thread)

» Is this the best birthday ever? (AKA the Thank You Serbia Thread AKA I am a Happy Chilean Thread)

Page 4 of 8

Permissions in this forum:

You cannot reply to topics in this forum

» Ruben Amorim Sack Watch

» The US Politics Thread

» The TV Series Thread - Part 5

» Vinicius Jr signs for Madrid

» Premier League 2024/25

» GL NBA fantasy 24-25

» The Official Real Madrid Matchday Thread 24 - 25

» La Liga 2024/25

» Raphinha's Ballon d'Or campaing

» Political Correctness, LGBTQ, #meToo and other related topics

» Hansi Flick Sack Watch

» Miguel "Miguelito" Gutierrez