The US Economy Thread

+12

I Have Mono

RedOranje

sportsczy

CBarca

RealGunner

Grooverider

Kaladin

zizzle

Swanhends

kiranr

Yuri Yukuv

BarrileteCosmico

16 posters

Page 1 of 8

Page 1 of 8 • 1, 2, 3, 4, 5, 6, 7, 8

The US Economy Thread

The US Economy Thread

Given that there's a bit of overlap with the Euro-Crisis thread I thought we might start a spin-off.

Good reading on the unemployment rate and participation percentage: http://ftalphaville.ft.com/2013/05/13/1496692/a-gap-ing-problem/

Good reading on the unemployment rate and participation percentage: http://ftalphaville.ft.com/2013/05/13/1496692/a-gap-ing-problem/

BarrileteCosmico- Admin

- Club Supported :

Posts : 28336

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

Its good that we have this thread started, the article by the team at Alphaville is insightful as usual but I think there is much more at play than they can explain in a short essay.

Btw, what is your view on what is happening in the US economy vis a vis the world? Where should the US economy be heading, and what would they need to do to get there?

Btw, what is your view on what is happening in the US economy vis a vis the world? Where should the US economy be heading, and what would they need to do to get there?

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 79

Re: The US Economy Thread

Re: The US Economy Thread

The US economy seems to be on track for recovery, it could be faster through easier policy but obviously if we compare it with Europe Bernanke looks relatively good. It's an outrage that the Fed is letting inflation reach 1% and that it doesn't think it will be able to get unemployment to 6.5% until 2015 according to the latest Fed projections while inflation expectations for the same period are 1.52% (measured by April TIPS spread for 2015). But at this point I see it as very unlikely that QE3 will get a boost. I think we could see the Fed starting to scale back on QE3 by June 2014, and possibly be done with the program by the end of that year under current projections.

Going forward I think it's quite clear that inflation targeting is dead and think other policy measures should be considered. Of these the most sensible to me is NGDP targeting (preferably in its LT version at around 4.5% trendline) due to its forward guidance and ability to encapsulate both aspects of the dual mandate in its target. The current Evans Rule is a step in the right direction but definitely not enough. The Fed is unlikely to adopt it, however, until it becomes more accepted by the average economist. There are good signs to show that this is happening, though, five years ago no one was talking about it whereas today Mark Carney was supposedly hired with the aim to install it in England.

Going forward I think it's quite clear that inflation targeting is dead and think other policy measures should be considered. Of these the most sensible to me is NGDP targeting (preferably in its LT version at around 4.5% trendline) due to its forward guidance and ability to encapsulate both aspects of the dual mandate in its target. The current Evans Rule is a step in the right direction but definitely not enough. The Fed is unlikely to adopt it, however, until it becomes more accepted by the average economist. There are good signs to show that this is happening, though, five years ago no one was talking about it whereas today Mark Carney was supposedly hired with the aim to install it in England.

BarrileteCosmico- Admin

- Club Supported :

Posts : 28336

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

Can somebody tell me to whom the money from the bond-buying program is going?

kiranr- First Team

- Club Supported :

Posts : 3496

Join date : 2011-06-06

Re: The US Economy Thread

Re: The US Economy Thread

kiranr wrote:

Can somebody tell me to whom the money from the bond-buying program is going?

commercial banks

Swanhends- Fan Favorite

- Club Supported :

Posts : 8451

Join date : 2011-06-05

Re: The US Economy Thread

Re: The US Economy Thread

Swanhends wrote:

commercial banks

What are these banks doing with it? Have you guys seen any pick up in commercial and retail loan transactions? Or is it being used to prop up the capital to meet capital requirements?

kiranr- First Team

- Club Supported :

Posts : 3496

Join date : 2011-06-06

Re: The US Economy Thread

Re: The US Economy Thread

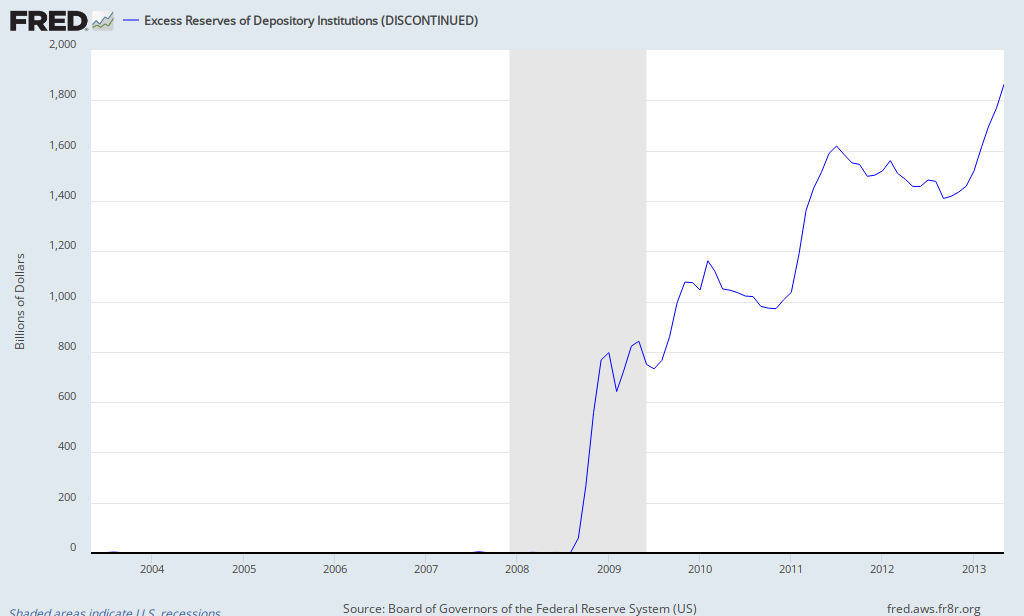

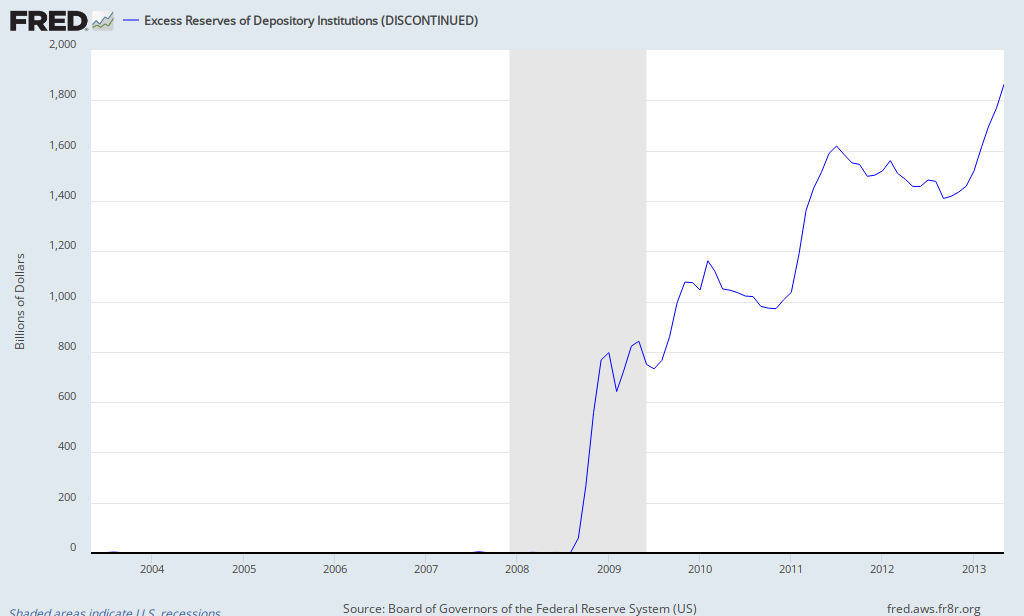

They're mostly holding it as excess reserves at the Fed where they collect a .25% annual interest. Prior to the recession the Fed didn't give banks any interest on reserves so there was no point in holding excess reserves other than to hedge for uncertain cash movements for the depository institutions, and that would not be a lot of money involved.

BarrileteCosmico- Admin

- Club Supported :

Posts : 28336

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

^ imagine the inflation when that money finds its way to the market

zizzle- Fan Favorite

- Club Supported :

Posts : 6887

Join date : 2011-06-05

Age : 104

Re: The US Economy Thread

Re: The US Economy Thread

Your fears are misplaced, there's no thread of inflation or hyperinflation under current policy

A) Right now inflation is a good thing because they decrease the real interest rate thus boosting investment, consumption and all these nice things

B) inflation expectations are very well anchored and have rarely been above 2%

C) even if some of it lead to inflation, which is very unlikely, the Fed has a myriad of policy tools to take care of it. They can raise the interest on reserves, decrease the monetary base, require banks to hold more reserves, etc. And the fed is very hawkish to inflation.

A) Right now inflation is a good thing because they decrease the real interest rate thus boosting investment, consumption and all these nice things

B) inflation expectations are very well anchored and have rarely been above 2%

C) even if some of it lead to inflation, which is very unlikely, the Fed has a myriad of policy tools to take care of it. They can raise the interest on reserves, decrease the monetary base, require banks to hold more reserves, etc. And the fed is very hawkish to inflation.

BarrileteCosmico- Admin

- Club Supported :

Posts : 28336

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

personally im very critical of inflation as a growth tool because more times than not the net result is barely positive. Bond investors only want real returns so with high inflation higher returns are needed and thus higher cost of capital for corporation. back to ground zero. As for the fed, they dont really have many choices if things go wrong, either a recession or inflation, because the tools you just mentioned will all hike up the interest rates and that kills growth. The interest rate reached 20% in 1981 as a result of inflation and the economy was in a better shape back then.

Anyway things could still go right and these reserves would go into productive investments (instead of going to the stock market like what's happening now) and the economy would recover, but personally im really not an optimist so...

Anyway things could still go right and these reserves would go into productive investments (instead of going to the stock market like what's happening now) and the economy would recover, but personally im really not an optimist so...

zizzle- Fan Favorite

- Club Supported :

Posts : 6887

Join date : 2011-06-05

Age : 104

Re: The US Economy Thread

Re: The US Economy Thread

Here's an article about inflation fears from Justin Wolfers at UMichigan

Justin Wolfers wrote:Paul Ryan believes the U.S. has a looming inflation problem. The reality is that Ryan has an economic credibility problem.

The latest iteration of the Wisconsin representative’s budget for the U.S. government spells out what he sees as a major threat to the economy: “Pressed for cash, the government will take the easy way out: It will crank up the printing presses. The final stage of this intergenerational theft will be the debasement of our currency. Government will cheat us of our just rewards. Our finances will collapse. The economy will stall.”

It’s a stark forecast, in which the driving force is “debasement of the currency,” which is simply a rhetorically loaded term for inflation. Ryan’s views on the economy are premised on his forecast that the country is headed for a central-bank induced monetary disaster.

This sort of fear-mongering sells well among gold bugs, doomsday preppers and other Tea Party types. But it rests on very shaky ground. So shaky, in fact, that either Ryan is being dishonest or he’s placed himself on the Spam-hoarding radical fringe, far outside any standard approach to monetary economics.

For instance, the latest projections from the Federal Reserve’s policy-setting Open Market Committee suggest that long-run inflation will average 2 percent, consistent with its stated long-run target. Of course, in Ryan’s view, the Fed would say that, just to hide its intentions ahead of an inflationary surprise.

What do professional economists say? The Survey of Professional Forecasters summarizes the projections of private- sector economists, academics and econometric models, lacking any nefarious agenda that one may ascribe to the Fed. In the latest survey, the median projection among these economists is for inflation to average 2 percent over the next decade. Even the most alarmist forecast sees inflation averaging no more than 3 percent. These 46 economists draw on a wide variety of views about the economy, yet Ryan is more extreme than all them -- by a substantial margin.

In other guises, Ryan is a believer in markets, another place where smart people try to forecast inflation. Consider the market for government bonds. The difference between the interest rates on two kinds of bonds -- 10-year government notes and otherwise-similar obligations whose payoff is indexed to inflation -- can be interpreted as a market-based inflation forecast. The current prices of these bonds suggest inflation is expected to average only 2.5 percent over the next decade. And this probably overstates things, because traders are often willing to pay more for inflation-linked bonds to insure against bad outcomes.

Why is everyone so much less worried about inflation than Ryan? Let’s reflect on the underlying forces that drive prices. Textbook economics relies on the Phillips curve, which suggests that inflation accelerates when the economy starts to overheat, or when inflation expectations get ignited. But expectations remain muted. With unemployment at a stubbornly high 7.7 percent (and in Ryan’s view, unlikely to fall soon), it’s hard to see inflationary pressures anywhere.

None of this is to say that inflation doesn’t remain a concern. Unwinding the Fed’s bond-buying program will require some care. And there are specific sectors that could heat up. It seems plausible that inflation could tick above 2 percent at some point. But this is still consistent with a working definition of price stability, and not “debasement of our currency.”

The point is that Ryan’s inflation forecast simply isn’t credible. It’s not just another slightly different view on the economy. It’s a radical departure from the views of those on both the left and the right. It’s so far from the realm of the likely that I have yet to see a serious Republican economist who would defend it.

So what’s really going on? Perhaps Ryan doesn’t actually believe his own inflated claims, and this is just cynical politics as usual. Fear is easy to sell, and he’s a willing purveyor. But to what end?

Inflation does have distributional effects, and perhaps he’s simply looking to protect those who gain most from price stability. That said, the winners and losers from inflation aren’t as obvious as one might think. It’s not clear why this should be a Republican cause.

Perhaps there’s a short-run political gain to playing Chicken Little during a moment in which the extreme elements of his party remain engaged even as most of the public is tuning out politics. But Ryan is an ambitious character, and surely such extremist views will prove to be a liability when the broader public tunes in to the 2016 election campaign.

The remaining possibility is more frightening. Perhaps Ryan really does believe this stuff. Perhaps the chairman of the House Budget Committee is actually an inflation nutter. Even more scary, perhaps he’s willing to act on his fears.

Swanhends- Fan Favorite

- Club Supported :

Posts : 8451

Join date : 2011-06-05

Re: The US Economy Thread

Re: The US Economy Thread

I agree with Zizzle

Kaladin- Stormblessed

- Club Supported :

Posts : 24585

Join date : 2012-06-28

Age : 31

Re: The US Economy Thread

Re: The US Economy Thread

The mechanism is not inflation itself but the expectation of inflation. Also if inflation were to pick up it would likely mean that the recovery is well under way (since it would be hard to have inflation with soaring unemployment) so contractionary policy would be in order. In any case you need to look no further than the TIPS spread to see that the market doesn't expect inflation to pick up soon or in the long term.zizzle wrote:personally im very critical of inflation as a growth tool because more times than not the net result is barely positive. Bond investors only want real returns so with high inflation higher returns are needed and thus higher cost of capital for corporation. back to ground zero. As for the fed, they dont really have many choices if things go wrong, either a recession or inflation, because the tools you just mentioned will all hike up the interest rates and that kills growth. The interest rate reached 20% in 1981 as a result of inflation and the economy was in a better shape back then.

Anyway things could still go right and these reserves would go into productive investments (instead of going to the stock market like what's happening now) and the economy would recover, but personally im really not an optimist so...

BarrileteCosmico- Admin

- Club Supported :

Posts : 28336

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

kiranr wrote:

Can somebody tell me to whom the money from the bond-buying program is going?

QE3 is not about bond buying, they are buying agency mortgage backed securities. There is around USD 125 Bn of mortgage backed securities issued by fannie and freddie every month and they buy half of that IIRC. So the money is going towards the issuers, services, homeowners (lower rates) etc.

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 79

Re: The US Economy Thread

Re: The US Economy Thread

Yuri Yukuv wrote:kiranr wrote:

Can somebody tell me to whom the money from the bond-buying program is going?

QE3 is not about bond buying, they are buying agency mortgage backed securities. There is around USD 125 Bn of mortgage backed securities issued by fannie and freddie every month and they buy half of that IIRC. So the money is going towards the issuers, services, homeowners (lower rates) etc.

This is partially correct:

So QE3 was initially going to purchase MBS at $40b per month and they added $45b monthly treasury purchases in December so that it would negate the contractionary impact of operation twist's end.To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee will continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will purchase longer-term Treasury securities after its program to extend the average maturity of its holdings of Treasury securities is completed at the end of the year, initially at a pace of $45 billion per month.

BarrileteCosmico- Admin

- Club Supported :

Posts : 28336

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

Were actually going through pretty scary disinflation right now

Look here

http://www.clevelandfed.org/research/data/inflation_expectations/2013/April//image1.gif

there has been a crash in commodity prices, which does not go well with the inflation scenario

and here

http://www.247bull.com/wp-content/uploads/cci-15-Feb-201311.jpg

Its important for us to see the economy as what, and not what we would like to see.

Look here

http://www.clevelandfed.org/research/data/inflation_expectations/2013/April//image1.gif

there has been a crash in commodity prices, which does not go well with the inflation scenario

and here

http://www.247bull.com/wp-content/uploads/cci-15-Feb-201311.jpg

Its important for us to see the economy as what, and not what we would like to see.

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 79

Re: The US Economy Thread

Re: The US Economy Thread

Pretty much what BC said

Kaladin- Stormblessed

- Club Supported :

Posts : 24585

Join date : 2012-06-28

Age : 31

Re: The US Economy Thread

Re: The US Economy Thread

Here's a piece by Christina Romer on Japan, the Great Depression, and the US today. I haven't finished reading it yet but what I like about it is that it's in plain English so it should be accessible for the average user:

http://emlab.berkeley.edu/~cromer/It%20Takes%20a%20Regime%20Shift%20Written.pdf

http://emlab.berkeley.edu/~cromer/It%20Takes%20a%20Regime%20Shift%20Written.pdf

BarrileteCosmico- Admin

- Club Supported :

Posts : 28336

Join date : 2011-06-05

Age : 34

Re: The US Economy Thread

Re: The US Economy Thread

For those that are not buying (no pun intended) into the main stream media propaganda machine.

It is good to try and see things from another perspective from time to time.

anyway, heres the link. Enjoy.

https://www.youtube.com/watch?v=bYkl3XlEneA

It is good to try and see things from another perspective from time to time.

anyway, heres the link. Enjoy.

https://www.youtube.com/watch?v=bYkl3XlEneA

Grooverider- Banned (Permanent)

- Posts : 571

Join date : 2013-02-10

Re: The US Economy Thread

Re: The US Economy Thread

^ that's the video i posted in the other thread but not a single comment was made.

zizzle- Fan Favorite

- Club Supported :

Posts : 6887

Join date : 2011-06-05

Age : 104

Re: The US Economy Thread

Re: The US Economy Thread

Yuri Yukuv wrote:Were actually going through pretty scary disinflation right now

Look here

http://www.clevelandfed.org/research/data/inflation_expectations/2013/April//image1.gif

there has been a crash in commodity prices, which does not go well with the inflation scenario

and here

http://www.247bull.com/wp-content/uploads/cci-15-Feb-201311.jpg

Its important for us to see the economy as what, and not what we would like to see.

You're questioning my loyalty ?

zizzle- Fan Favorite

- Club Supported :

Posts : 6887

Join date : 2011-06-05

Age : 104

Re: The US Economy Thread

Re: The US Economy Thread

I just wrote a f*cking novel about that video and I accidentally hit the delete key when not in the textbox....took me back to the previous screen

Long story short I got 1/2 way through the video and while the guy has some legitimate concerns, he's horribly wrong/misguided on a lot of this stuff (IMO), in addition to seemingly pulling numbers out of mid-air (does he source this stuff at the end?)

Seriously can't believe I just lost all that shit I just spent 35 minutes procrastinating studying for finals to write

Long story short I got 1/2 way through the video and while the guy has some legitimate concerns, he's horribly wrong/misguided on a lot of this stuff (IMO), in addition to seemingly pulling numbers out of mid-air (does he source this stuff at the end?)

Seriously can't believe I just lost all that shit I just spent 35 minutes procrastinating studying for finals to write

Swanhends- Fan Favorite

- Club Supported :

Posts : 8451

Join date : 2011-06-05

Re: The US Economy Thread

Re: The US Economy Thread

LMAO been there, but the newer version of Chrome saves your text when you go backwards then forward. Saved me a lot of trouble

zizzle- Fan Favorite

- Club Supported :

Posts : 6887

Join date : 2011-06-05

Age : 104

Re: The US Economy Thread

Re: The US Economy Thread

zizzle wrote:LMAO been there, but the newer version of Chrome saves your text when you go backwards then forward. Saved me a lot of trouble

I might have to get Chrome for this reason alone, this has happened to me so many times on GL...dat feel

This is really stupid but the reason I don't have Chrome now is that I figured Google already knows enough about me from my search history, emails, cellphone etc, I should at least give someone else my browsing history...diversification

Swanhends- Fan Favorite

- Club Supported :

Posts : 8451

Join date : 2011-06-05

Re: The US Economy Thread

Re: The US Economy Thread

I'll put in something that automatically saves ur text. Wait for a week

RealGunner- Admin

- Club Supported :

Posts : 89513

Join date : 2011-06-05

Page 1 of 8 • 1, 2, 3, 4, 5, 6, 7, 8

Similar topics

Similar topics» Trump doing better in economy and job creation than " 2% growth is the new norm Obama"

» OFFICIAL THREAD -Juve - X [ MATCH THREAD,NEWS,LINEUPS,MATCHES, PRE-SEASON ]

» Official "I want to hit Neil Lennon" Thread. A.K.A Juve - Celtic game thread.

» The Rage thread Pt 2(AKA lets go for CL and Copa and forget about liga thread)

» Is this the best birthday ever? (AKA the Thank You Serbia Thread AKA I am a Happy Chilean Thread)

» OFFICIAL THREAD -Juve - X [ MATCH THREAD,NEWS,LINEUPS,MATCHES, PRE-SEASON ]

» Official "I want to hit Neil Lennon" Thread. A.K.A Juve - Celtic game thread.

» The Rage thread Pt 2(AKA lets go for CL and Copa and forget about liga thread)

» Is this the best birthday ever? (AKA the Thank You Serbia Thread AKA I am a Happy Chilean Thread)

Page 1 of 8

Permissions in this forum:

You cannot reply to topics in this forum|

|

|

» The Official Real Madrid Matchday Thread 24 - 25

» Speculative thread for 2022/23 squad

» GL NBA fantasy 24-25

» Mbappe signs for Real Madrid.

» Paul Pogba - The resurgence

» Serie A 2024/2025

» Erik Ten Hag Sack Watch

» Mbappe to Real Madrid - Official

» The Lionel Messi Appreciation Thread & Fan Club IV

» MLS-thread

» Champions League '24/25

» General Games Discussion