Euro Crisis Returns

+16

sportsczy

kiranr

Grooverider

Art Morte

VivaStPauli

StrugaRock

free_cat

rwo power

Onyx

Highburied

Swanhends

CBarca

BarrileteCosmico

RealGunner

zizzle

Yuri Yukuv

20 posters

Page 4 of 5

Page 4 of 5 •  1, 2, 3, 4, 5

1, 2, 3, 4, 5

Re: Euro Crisis Returns

Re: Euro Crisis Returns

Difference is that in the US the primary objective of QE2 at least was to avoid deflation whereas in Japan it is to get out of persistent deflation, which is proving quite trickier.

BarrileteCosmico- Admin

- Posts : 28292

Join date : 2011-06-05

Re: Euro Crisis Returns

Re: Euro Crisis Returns

zizzle wrote:The Japanese basically doubled inflation, eased monitory policy, and devalued the yen and suddenly their market is doing great. Sounds all too familiar..

As in similarity to U.S?

Eased monetary policy and strong market check the boxes, but U.S inflation is still trailing the 2% target and hasn't the USD appreciated against GBP and Euro?

On an unrelated note, some other interesting stuff I read on twitter regarding media commentary on economic situation

This was from @economisthulk on Non-EuroZone developed economies (Got rid of the caps and hulk-speak, though I enjoy both):

1/5 Canada has inflation close to target, no financial crisis, no austerity, and an unemployment problem

2/5 UK has persistently above target inflation, massive financial crisis, some austerity, huge deficits, unemployment H

3/5 Switzerland has very low inflation, very low unemployment, financial crisis, no austerity, and budget surpluses (Huge current account surplus, but this coincided with deflation)

4/5 US has below target inflation, massive financial crisis, some austerity, big but falling deficits, and unemployment problem

5/5 On basis of most media commentary, Hulk would have no idea how to reconcile previous tweets

Swanhends- Fan Favorite

- Club Supported :

Posts : 8451

Join date : 2011-06-05

Re: Euro Crisis Returns

Re: Euro Crisis Returns

Swanhends wrote:zizzle wrote:The Japanese basically doubled inflation, eased monitory policy, and devalued the yen and suddenly their market is doing great. Sounds all too familiar..

As in similarity to U.S?

Eased monetary policy and strong market check the boxes, but U.S inflation is still trailing the 2% target and hasn't the USD appreciated against GBP and Euro?

It did today, but that's only because the Fed has announced that it's considering easing off the QE. The dollar hiked and the market went down, but it was typical investor overreacting. The trend isnt reversed.

http://blogs.marketwatch.com/thetell/2013/05/13/fed-looks-to-qe-exit-investors-react/

On the other side the European Central Bank is also perusing a relaxed monitory policy so the Euro is more likely to go down

This whole thing got me interested in the Austrian school of economics. Any thoughts on the topic ?

zizzle- Fan Favorite

- Club Supported :

Posts : 6887

Join date : 2011-06-05

Age : 103

Re: Euro Crisis Returns

Re: Euro Crisis Returns

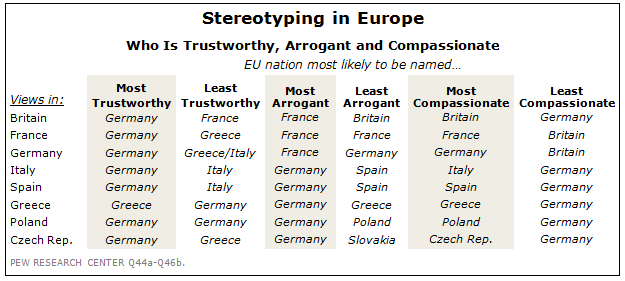

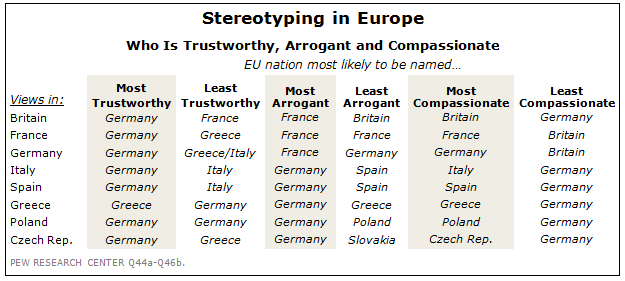

Ahahahahah this is table of survey done by pew!

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 78

Re: Euro Crisis Returns

Re: Euro Crisis Returns

Germany is the Mou of Europe

Whether you love them or hate them, one thing if for sure: you can't stop talking about them

Whether you love them or hate them, one thing if for sure: you can't stop talking about them

Swanhends- Fan Favorite

- Club Supported :

Posts : 8451

Join date : 2011-06-05

Re: Euro Crisis Returns

Re: Euro Crisis Returns

Italy and Czech Republic the only ones that didn't see themselves as "least" arrogant

How does France see itself as most and least arrogant at the same time?

Poland thinks that Germany is the most trustworthy and least trustworthy as well.

How does France see itself as most and least arrogant at the same time?

Poland thinks that Germany is the most trustworthy and least trustworthy as well.

BarrileteCosmico- Admin

- Club Supported :

Posts : 28292

Join date : 2011-06-05

Age : 33

Re: Euro Crisis Returns

Re: Euro Crisis Returns

For those that are not buying (no pun intended) into the main stream media propaganda machine.

It is good to try and see things from another perspective from time to time.

anyway, heres the link. Enjoy.

https://www.youtube.com/watch?v=UYtbEJfQtDI

It is good to try and see things from another perspective from time to time.

anyway, heres the link. Enjoy.

https://www.youtube.com/watch?v=UYtbEJfQtDI

Grooverider- Banned (Permanent)

- Posts : 571

Join date : 2013-02-10

Re: Euro Crisis Returns

Re: Euro Crisis Returns

France is back into recession

Eurocrats have shown that they are completely incompetent

French economy returns to recession

Official figures show

France has entered its second recession in four years after the economy

shrank by 0.2% in the first quarter of the year.

Its economy shrank by the same amount in the last quarter of

2012. A recession is defined as two consecutive quarters of negative

growth.

France has record unemployment and low business and consumer confidence.

German figures, also released, showed its economy, the eurozone's strongest, grew by just 0.1% in the first quarter.

France entered its worst recession since World War II in

2009. Although it was thought to have been in recession in 2012, these

figures have now been revised to show only one quarter of negative

growth.

The news comes on the first anniversary of Francois Hollande being sworn in as president.

Eurocrats have shown that they are completely incompetent

French economy returns to recession

Official figures show

France has entered its second recession in four years after the economy

shrank by 0.2% in the first quarter of the year.

Its economy shrank by the same amount in the last quarter of

2012. A recession is defined as two consecutive quarters of negative

growth.

France has record unemployment and low business and consumer confidence.

German figures, also released, showed its economy, the eurozone's strongest, grew by just 0.1% in the first quarter.

France entered its worst recession since World War II in

2009. Although it was thought to have been in recession in 2012, these

figures have now been revised to show only one quarter of negative

growth.

The news comes on the first anniversary of Francois Hollande being sworn in as president.

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 78

Re: Euro Crisis Returns

Re: Euro Crisis Returns

From Robert Kuttner at Echoes

Germany's Perverse Devotion to Austerity

Next summer will mark the 100th anniversary of the chain of diplomatic missteps that led to World War I. In light of recent economic blunders, this also should be the opportunity to revisit the war’s aftermath, when miscalculations seeded the conditions that led to World War II.

In 1919, at the Versailles Peace Conference, France and the U.K. resolved to impose draconian “reparation” payments on a defeated Germany. The idea was both to compensate the U.K. and France for the horrific costs of the war, and to ensure that Germany could never again threaten Europe.

The terms required Germany to make an initial payment of $5 billion, almost half of Germany’s annual gross domestic product, by May 1921, -- plainly an impossible sum. The postwar settlement included no recovery plan for Germany; on the contrary, it was required to transfer lands and industrial assets to the Allies.

This financial vise led directly to the ruin of Germany’s economy, its recourse to printing money, the hyperinflation of 1923, the destruction of the middle class and the rise of Adolf Hitler.

A generation later, the Allies again faced a defeated and destitute Germany. Then, too, many leaders wanted to destroy it as an industrial power. The U.S. Treasury secretary, Henry Morgenthau, had a plan to make Germany a largely agricultural economy. Soviet leader Josef Stalin expropriated German factories as a down payment on reparations.

Cold War

But that policy soon changed to one of relief and recovery, not because the Allies had learned from history, but because of the incipient Cold War. The U.S. needed a strong Germany.

The emblem of the European recovery policy was the Marshall Plan. However, even more important was forgiveness of German war debt.

In prosecuting World War II, Hitler ran up the largest share of national debt to GDP of any country --- 675 percent. In June 1948, as part of a currency reform that created the new deutsche mark, the Allies canceled 93 percent of the Hitler-era debt. Repayment of the rest was deferred for almost half a century.

As a result, West Germany had a debt of about 12 percent of GDP in the early 1950s, far smaller than the liabilities of the victorious Allies, which had sacrificed to defeat Hitler. This act of macroeconomic mercy was key to the postwar German economic miracle.

Germany today is the enforcer of European austerity, and the cancellation of most of the Nazi war debt in 1948 has disappeared from the national memory. Had Germany been kept in a straitjacket of debt repayment, its path to recovery would have been far more arduous. It might never have returned to democracy.

As the dominant political and economic power of the European Union, Germany is imposing a perverse austerity on smaller and weaker nations for three interconnected reasons.

Many Germans, including those in the government of Chancellor Angela Merkel, draw questionable lessons from their own history. The hyperinflation after World War I is taken as a cautionary lesson about fiscal and monetary discipline. What’s forgotten is that Weimar Germany’s ruinous actions in 1923 were the result of external pressures to collect impossible-to-repay debts in desperate times, not the result of Germany’s own profligacy.

German Reunification

Second, the rest of Europe is being required to atone for Germany’s sins. In the years after reunification in 1989-90, the federal government in Berlin spent about 2 trillion euros ($2.6 trillion) on the reconstruction of eastern Germany. The Bundesbank raised interest rates to contain inflation, resulting in higher credit costs across Europe. Germany demanded that all the major European nations run deficits that exceeded the fiscal limits of the 1993 Maastricht Treaty on European Union as a way to combat a recession.

When Merkel became chancellor in 2005, she resolved to rigidly enforce the treaty’s deficit-and-debt limits, including sanctions. This policy arguably made sense in good economic times, but it is the opposite of what’s needed after a financial collapse.

Third, Germany’s own self-interest undermines enlightened policies for the rest of the continent. Economists at the University of Munich have calculated that if Germany still had the deutsche mark, it would trade about 40 percent higher than the euro. For Germany, an undervalued euro produces a huge export advantage. Also, the crisis elsewhere attracts capital, giving the Germans artificially low interest rates. The nation that gave us the term schadenfreude profits from the misfortune of others while presenting itself as a role model.

Lately, the rest of Europe has turned against austerity. Spain, Portugal, France and Italy have all moved to ease belt tightening. But Germany still vetoes pan-European solutions. Greece, under pressure from the “troika” -- the European Commission, the European Central Bank and the International Monetary Fund -- just fired an additional 15,000 civil servants, to qualify for the latest installment of bailout funds. But the aid goes to repay creditors, not to help Greece, where unemployment is approaching 30 percent.

In 1948, when U.S. President Harry Truman was promoting the Marshall Plan and wrote off most of Germany’s debt, he was monumentally unpopular in the U.S. and widely expected to lose the November election. But he risked his presidency on an act of statesmanship, and went on to win.

Chancellor Merkel faces re-election in September. Mercy for Europe’s presumed fiscal sinners isn’t popular with the German electorate.

Though there is no Cold War to justify a fiscal amnesty, the debt relief of 1948 was a central reason for Germany’s rise to its current pre-eminence. This would be a good moment for Merkel to revisit her nation’s history and lead Germany to a more enlightened self-interest.

Germany's Perverse Devotion to Austerity

Next summer will mark the 100th anniversary of the chain of diplomatic missteps that led to World War I. In light of recent economic blunders, this also should be the opportunity to revisit the war’s aftermath, when miscalculations seeded the conditions that led to World War II.

In 1919, at the Versailles Peace Conference, France and the U.K. resolved to impose draconian “reparation” payments on a defeated Germany. The idea was both to compensate the U.K. and France for the horrific costs of the war, and to ensure that Germany could never again threaten Europe.

The terms required Germany to make an initial payment of $5 billion, almost half of Germany’s annual gross domestic product, by May 1921, -- plainly an impossible sum. The postwar settlement included no recovery plan for Germany; on the contrary, it was required to transfer lands and industrial assets to the Allies.

This financial vise led directly to the ruin of Germany’s economy, its recourse to printing money, the hyperinflation of 1923, the destruction of the middle class and the rise of Adolf Hitler.

A generation later, the Allies again faced a defeated and destitute Germany. Then, too, many leaders wanted to destroy it as an industrial power. The U.S. Treasury secretary, Henry Morgenthau, had a plan to make Germany a largely agricultural economy. Soviet leader Josef Stalin expropriated German factories as a down payment on reparations.

Cold War

But that policy soon changed to one of relief and recovery, not because the Allies had learned from history, but because of the incipient Cold War. The U.S. needed a strong Germany.

The emblem of the European recovery policy was the Marshall Plan. However, even more important was forgiveness of German war debt.

In prosecuting World War II, Hitler ran up the largest share of national debt to GDP of any country --- 675 percent. In June 1948, as part of a currency reform that created the new deutsche mark, the Allies canceled 93 percent of the Hitler-era debt. Repayment of the rest was deferred for almost half a century.

As a result, West Germany had a debt of about 12 percent of GDP in the early 1950s, far smaller than the liabilities of the victorious Allies, which had sacrificed to defeat Hitler. This act of macroeconomic mercy was key to the postwar German economic miracle.

Germany today is the enforcer of European austerity, and the cancellation of most of the Nazi war debt in 1948 has disappeared from the national memory. Had Germany been kept in a straitjacket of debt repayment, its path to recovery would have been far more arduous. It might never have returned to democracy.

As the dominant political and economic power of the European Union, Germany is imposing a perverse austerity on smaller and weaker nations for three interconnected reasons.

Many Germans, including those in the government of Chancellor Angela Merkel, draw questionable lessons from their own history. The hyperinflation after World War I is taken as a cautionary lesson about fiscal and monetary discipline. What’s forgotten is that Weimar Germany’s ruinous actions in 1923 were the result of external pressures to collect impossible-to-repay debts in desperate times, not the result of Germany’s own profligacy.

German Reunification

Second, the rest of Europe is being required to atone for Germany’s sins. In the years after reunification in 1989-90, the federal government in Berlin spent about 2 trillion euros ($2.6 trillion) on the reconstruction of eastern Germany. The Bundesbank raised interest rates to contain inflation, resulting in higher credit costs across Europe. Germany demanded that all the major European nations run deficits that exceeded the fiscal limits of the 1993 Maastricht Treaty on European Union as a way to combat a recession.

When Merkel became chancellor in 2005, she resolved to rigidly enforce the treaty’s deficit-and-debt limits, including sanctions. This policy arguably made sense in good economic times, but it is the opposite of what’s needed after a financial collapse.

Third, Germany’s own self-interest undermines enlightened policies for the rest of the continent. Economists at the University of Munich have calculated that if Germany still had the deutsche mark, it would trade about 40 percent higher than the euro. For Germany, an undervalued euro produces a huge export advantage. Also, the crisis elsewhere attracts capital, giving the Germans artificially low interest rates. The nation that gave us the term schadenfreude profits from the misfortune of others while presenting itself as a role model.

Lately, the rest of Europe has turned against austerity. Spain, Portugal, France and Italy have all moved to ease belt tightening. But Germany still vetoes pan-European solutions. Greece, under pressure from the “troika” -- the European Commission, the European Central Bank and the International Monetary Fund -- just fired an additional 15,000 civil servants, to qualify for the latest installment of bailout funds. But the aid goes to repay creditors, not to help Greece, where unemployment is approaching 30 percent.

In 1948, when U.S. President Harry Truman was promoting the Marshall Plan and wrote off most of Germany’s debt, he was monumentally unpopular in the U.S. and widely expected to lose the November election. But he risked his presidency on an act of statesmanship, and went on to win.

Chancellor Merkel faces re-election in September. Mercy for Europe’s presumed fiscal sinners isn’t popular with the German electorate.

Though there is no Cold War to justify a fiscal amnesty, the debt relief of 1948 was a central reason for Germany’s rise to its current pre-eminence. This would be a good moment for Merkel to revisit her nation’s history and lead Germany to a more enlightened self-interest.

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 78

Re: Euro Crisis Returns

Re: Euro Crisis Returns

And force the bankers to take a loss?

kiranr- First Team

- Club Supported :

Posts : 3496

Join date : 2011-06-06

Re: Euro Crisis Returns

Re: Euro Crisis Returns

kiranr wrote:

And force the bankers to take a loss?

That was a really bad move by germany, and in the long run hurtful to the periphery. We saw how yields spiked after that and the domino effect almost took place.

What europe needs (especially periphery) is more competitive labor and smaller government wages (as % of GDP) because those are fixed costs that will hurt bad in a recession in addition to other ills (misallocation of labor and capital).

If I was the german decision maker I would allow more fisccal deficits on condition that government wages got smaller and that the debt would be used in infrastructure projects, I would also allow more monetization as long as labor markets got more competitive. These steps would benefit the european private sector immensely.

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 78

Re: Euro Crisis Returns

Re: Euro Crisis Returns

Wouldn't have expected you to go all liberal on the economics.

VivaStPauli- Fan Favorite

- Club Supported :

Posts : 9002

Join date : 2011-06-05

Age : 39

Re: Euro Crisis Returns

Re: Euro Crisis Returns

http://www.zerohedge.com/news/2013-05-18/spot-odd-continent-out-total-bank-assets-gdp

Some EU insight.

kiranr- First Team

- Club Supported :

Posts : 3496

Join date : 2011-06-06

Re: Euro Crisis Returns

Re: Euro Crisis Returns

VivaStPauli wrote:Wouldn't have expected you to go all liberal on the economics.

I think realistically under the current european political situation allowing temporary fiscal deficits with set goals while decreasing government wages is the right way to go, it will be very hard for any european periphery to accept the latter without getting something in return.

This would create small liabilities in the short term while getting rid of bigger longer liabilities, further if the monetary policy outpaces fiscal spending net-net it will result in increased clout for the private sector.

I am more of a monetarist on the path of friedman than an austrian, but just because the former lends itself more easily to abuse I would much rather have the latter than crony monetarism or Keynesian economics.

If there is anything that we have learned over the past four or five years from this crisis its that monetarism is much much more effective than the other two approaches.

Weve seen the Keynesian approach taken by the Obama administration in the first term through increased fiscal stimulus (describing it as a titanic stimulus would be an understatement) financed by the fed through QE1 and QE2, that took us nowhere except to more inequality as the rich became richer and the poor became poorer and government becoming larger these measures were also highly discretionary and not rules based at all.

In Europe we saw completely discretionary policy making by the eurocrats which created unprecedented confusion in the markets, trust in europe collapsed as a result of this.

On the other hand as opposition to the Obama administration became stronger in the second term we have seen decreased government spending as a result of the sequester. This was coupled with increased monetization of non-government debt in the US (Agency MBS) as there was no need to buy treasuries anymore (less fiscal spending) , increased rule making as opposed to discretionary policy making (buying until unemployment target is down to 6.5%) and transparency (federal reserve minutes and opinions are very detailed now). This created an unintended monetarist policy and we are reaping the results of this now.

Another example of monetarist policy is Abenomics which is the first intended application of monetarist policy in a decade or so, I am very confident about its prospects and so are most economists. We got the first taste of such success after the huge beat in GDP for Q1

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 78

Re: Euro Crisis Returns

Re: Euro Crisis Returns

Unions That Built Germany Eroded by Rules Buoying Economy

Germany’s top trade unionist, Michael Sommer, looked out on a May Day crowd of workers and told them that a proposed labor flexibility plan wouldn’t create a single job.

Ten years later, the plan is law. Joblessness is close to a two-decade low and employment has increased by more than 3 million.

It’s unions whose numbers are diminishing. As more and more employees work for temporary agencies or on project-driven contracts, the jobs being created are mostly non-union, in a country whose modern form was built by organized labor.

Founded in the mid-19th century, German unions rose to power in the 1950s, when they were crucial in turning an economy shattered by World War II into an economic miracle. Their impact is waning at a time when Germany is being held up as a model for debt-stricken Europe.

“The influence of labor unions has diminished significantly as a result of those reforms,” said Thomas Harjes, senior European economist at Barclays Bank Plc in Frankfurt. “They’re fighting hard to win back some sway.”

Labor’s latest woes are being heard by Germany’s leadership. Chancellor Angela Merkel, who’s running for re- election this year from the Christian Democratic Union, said in January after meeting with the DGB union federation’s Sommer that Germany needed to “keep an eye” on contract work. It “can increasingly turn into circumvention of sensible union agreements,” she said.

Schroeder’s Plan

Unions represented 25 percent of the German workforce in 2000, three years before then-Chancellor Gerhard Schroeder started implementing a program for labor-market flexibility.

That number dropped to 18 percent in 2011, according to the Organization for Economic Cooperation and Development, as less generous jobless benefits and easier rules on firing pushed workers into lower-paid temporary jobs. The absolute number of union members fell by 21 percent.

At the same time, the new flexibility helped the German economy, Europe’s largest, contain unemployment during the 2009 crisis and emerge faster and stronger from the recession than most of its euro-region peers.

“Germany was a decade ago called the ‘sick man’ of Europe,” European Central Bank Executive Board member Joerg Asmussen said in a Frankfurt speech last month. “Since then, the country has become a showcase of how well-designed reforms can turn the situation around.”

Unemployed Youth

German employment was almost 42 million in March, the most on record, the government said today. Unemployment, at 5.4 percent on an EU-harmonized basis, is the lowest in the euro area after Austria and less than half of the average in the 17- nation region. Youth joblessness of 7.6 percent in Germany compares with 24 percent in the euro area.

Temporary work is one way for them to find employment. In Germany, about 7,500 agencies offer workers a job via that channel. ManpowerGroup Deutschland, the third-largest, employed about 20,000 people last year, twice as many as 2002.

“Temporary work has a reputation problem, which is unfortunate,” said Stephan Rathgeber, spokesman for the Eschborn, Germany-based company. “It facilitates the entry into the labor market, protects against unemployment in times of crises and is especially attractive for qualified workers.”

For Benjamin Fendt, 21, temporary work meant posts at 18 different companies after he finished his apprenticeship as an industrial and precision machinist in 2010. Sometimes the turnover was just over a week.

Too Qualified

“Temporary work was the only option to make some money,” he said in a phone interview from Landshut, Germany. “I had hoped to stay somewhere longer. All I wanted was a secure job.”

What he got was work he was overqualified or not trained for, long commutes and trouble with pay; and after an odyssey of more than two years a permanent job at plastics company Riedl Kunststofftechnik und Formenbau GmbH & Co.KG in Erding, Germany.

Fendt has been a member of IG Metall, Germany’s biggest union, since 2011, an example of how unions are beginning to court temp workers. Today, about 20 percent of all workers on loan in the metal industry are members, compared with almost 50 percent of permanent staff.

Another sector with union representation is contract work, which grew last year after unions and employers began agreeing to introduce minimum wages for temporary workers. While employees in temporary work are lent to a company for a specific period of time, contract workers are employed for a specific project, with pay often falling short of hourly wage minimums.

Fewer Accords

The share of companies following collective wage agreements fell to 47 percent in 2006 from 63 percent in 2001, according to an OECD report published in September.

“We have to adapt to a changing environment,” said Peter Donath, who heads the operations and participation-policy division at IG Metall in Frankfurt. “For a long time, we haven’t paid attention to temporary and contract work because we were focusing on our core factories.”

While IG Metall membership has edged higher in the past two years, at 2.26 million it is still almost 500,000 lower than at the beginning of the century.

Similarly, Ver.di, Germany’s biggest union when it was founded in 2001, has lost more than a quarter of its force since then and has ranked second behind IG Metall since 2005.

“Since the crisis, sentiment has changed,” said Christoph Schmitz, spokesman for Ver.di in Berlin. “The feeling among workers that somebody needs to represent their interests has increased.” In the first quarter, more people joined Ver.di, which represents services workers, than left the union.

Rising Rarely

Elsewhere in Europe, union membership has risen in seven euro countries studied by the OECD and declined in eight in the past decade. As a percent of the work force membership has risen in only two: Belgium and Italy.

Schroeder, from the Social Democratic Party, first outlined his intentions to change the labor system in March 2003, six months after his government was re-elected by the narrowest margin since 1945. At that time, the economy was contracting at the fastest pace in seven years and unemployment was approaching 10 percent, tied with Greece for second-highest after Spain.

The laws lowered welfare payments for long-term unemployed, withheld benefits from unemployed people who reject job offers and shortened the period for assistance. The measures also reduced early-retirement options and made it easier for companies to lay off employees in a country with employment protection stronger than the OECD average.

Two Classes?

Temporary and contract work spiraled in response. In June last year, 908,000 people were working on loan, one third of them in the metal and electrical industries, a traditional union stronghold, according to data by Germany’s Labor Agency. In 2000, temporary work had encompassed 338,000 workers.

“New forms of work have created two classes of employment, with different conditions for core and temporary workers,” said Ulrich Walwei, deputy director of Germany’s Institute for Employment Research in Nuremberg. “If temporary contracts were a transition into perpetual work, unions could probably live with it. But unfortunately, they’re sometimes just revolving doors.”

Almost half of all temporary contracts end after less than three months and, at 1,419 euros ($1,858) per month on average, pay little more than half of regular employment in 2010, according to labor-agency data.

Still, wage disparity narrowed last year with the introduction of industry premiums in pay. They add as much as 50 percent to hourly wages of temporary workers in the metal and electrical industries, according to IG Metall data.

More Strikes

At the same time, labor unrest has increased during the crisis. Deutsche Lufthansa AG (LHA) had to suspend almost its entire flight timetable on April 22 as workers struck over pay, and auto workers may strike across the country this month. German unemployment rose for a second month in April, to a seasonally adjusted 2.94 million.

Union leader Sommer, who characterized his ties to Schroeder as a “civilized non-relationship” in an interview with German newspaper Die Welt this month, hasn’t changed his view that the success of the economy isn’t related to the labor- market reform of the early 2000s.

“It was and is our strong export economy, flexible work models, co-management, free collective bargaining and last but not least wise crisis politics in 2008 and 2009,” he said. The labor changes mean “dumping wages, precarious employment, a low-wage sector and old-age poverty.”

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 78

Re: Euro Crisis Returns

Re: Euro Crisis Returns

Bullard educating the Euros

Fed’s Bullard Says ECB Needs ‘Aggressive’ QE to Avoid Japan Fate

Federal Reserve Bank of St. Louis President James Bullard said Europe risks an extended period of low growth and deflation like Japan’s unless the European Central Bank acts with an aggressive quantitative easing program.

“You should worry about it, and then take policy action to avoid it,” Bullard said in Frankfurt today in response to an audience question after a speech. “You want to be pretty sure that you don’t get stuck in that situation, and one way to get stuck would be to be passive in this situation and not take some aggressive action to try to get inflation back.”

While the ECB has lent banks unlimited funds for up to three years and pledged to buy bonds of countries engaged in economic adjustment plans, policy makers have shied away from committing to bond buying known as quantitative easing. Bullard, who votes on the Federal Open Market Committee this year, and his colleagues in the U.S. are buying $85 billion in Treasuries and mortgage-backed securities a month to spur growth.

“The lesson in Japan is once you get stuck there, it’s pretty hard to get out,” Bullard said today at the Institute for Monetary and Financial Stability. “They’re trying very hard right now and so maybe they’ll be successful but this time around we’ll see. But it’s been very hard to get out.”

Speaking in the ECB’s home town, Bullard said the central bank’s governing council may want to consider a quantitative easing program that’s weighted to account for gross domestic product differences in the 17-member euro area.

Extending Recession

The euro-area economy shrank more than economists forecast in the three months through March, extending a recession to a record sixth quarter. GDP fell 0.2 percent after a 0.6 percent decline in the previous quarter, the European Union’s statistics office in Luxembourg said on May 15. The annual inflation rate dipped to 1.2 percent in April, the lowest since February 2010. The ECB aims at inflation just under 2 percent.

Bank of Japan Governor Haruhiko Kuroda said April 4 he would double the purchases of government bonds to more than 7 trillion yen ($68.3 billion) a month to achieve 2 percent inflation in two years. Prime Minister Shinzo Abe’s government announced 10.3 trillion yen in extra spending in January to stimulate an economy that shrank for two quarters last year.

15 Years

“They just stayed at zero for 15 years thinking that eventually they would come out of that equilibrium and it never happened, so now they’re having to take more extreme measures,” Bullard said today of interest rates in the world’s third-largest economy, which fell behind China in 2010.

Bullard said in his prepared remarks that the Fed should continue its bond buying because it’s the best available option for policy makers to boost growth that is slower than expected.

The purchases known as quantitative easing should be maintained in the U.S. because financial markets indicate that they are improving financial conditions and can be adjusted based on how the economy changes, Bullard said today.

“Quantitative easing is closest to standard monetary policy, involves clear action and has been effective,” Bullard said. The panel should continue the program while “adjusting the rate of purchases appropriately in view of incoming data on both real economic performance and inflation.”

Fed officials are debating how and when to eventually curtail the purchases that have expanded the central bank’s balance sheet to a record $3.35 trillion. The FOMC said May 1 it will keep buying $85 billion in Treasuries and mortgage bonds per month to boost employment and spur the economy.

Bullard, 52, joined the St. Louis Fed’s research department in 1990 and became president of the regional bank in 2008. His district includes Arkansas and parts of Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee.

Yuri Yukuv- First Team

- Club Supported :

Posts : 1974

Join date : 2011-06-05

Age : 78

Re: Euro Crisis Returns

Re: Euro Crisis Returns

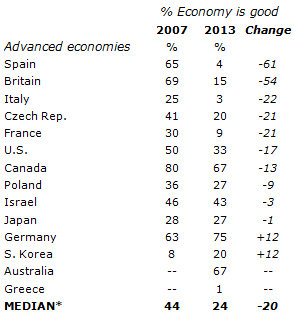

Germany keeps on improving at other country's expense

BarrileteCosmico- Admin

- Club Supported :

Posts : 28292

Join date : 2011-06-05

Age : 33

Re: Euro Crisis Returns

Re: Euro Crisis Returns

Eurozone unemployment reaches new record high in April

Unemployment in the eurozone has reached another record high, according to official figures.

The seasonally-adjusted rate for April was 12.2%, up from 12.1% the month before.

An extra 95,000 people were out of work in the 17 countries that use the euro, taking the total to 19.38 million.

Both Greece and Spain have jobless rates above 25%. The lowest unemployment rate is in Austria at 4.9%.

The European Commission's statistics office, Eurostat, said Germany had an unemployment rate of 5.4% while Luxembourg's was 5.6%.

The highest jobless rates are in Greece (27.0% in February 2013), Spain (26.8%) and Portugal (17.8%).

In France, Europe's second largest economy, the number of jobless people rose to a new record high in April.

"We do not see a stabilisation in unemployment before the middle of next year," said Frederik Ducrozet, an economist at Credit Agricole in Paris. "The picture in France is still deteriorating."

'Social crisis'

Youth unemployment remains a particular concern. In April, 3.6 million people under the age of 25 were out of work in the eurozone, which translated to an unemployment rate of 24.4%.

Figures from the Italian government showed 40.5% of young people in Italy are unemployed.

"We have to deal with the social crisis, which is expressed particularly in spreading youth unemployment, and place it at the centre of political action," said Italy's President Giorgio Napolitano.

In the 12 months to April, 1.6 million people lost their jobs in the eurozone.

While the jobless figure in the eurozone climbed for the 24th consecutive month, the unemployment rate for the full 27-member European Union remained at 11%.

The eurozone is in its longest recession since it was created in 1999. At 1.4%, inflation is far below the 2% target set by the European Central Bank (ECB).

Consumer spending remains subdued. Figures released on Friday showed that retail sales in Germany fell 0.4% in April compared with the previous month.

Earlier this week, the Organisation for Economic Co-operation and Development (OECD) predicted that the eurozone economy would contract by 0.6% this year.

According to Carsten Brzeski, an economist at ING, in the past, the eurozone has needed economic growth of about 1.5% to create jobs.

ECB action?

Some consider that the ECB needs to do more than simply cutting interest rates to boost economic activity and create jobs.

Earlier this month, the ECB lowered its benchmark interest rate to 0.50% from 0.75%, the first cut in 10 months, and said it was "ready to act if needed" if more measures were required to boost the eurozone's economic health.

In its report earlier this week, the OECD hinted that the ECB might want to expand quantitative easing (QE) as a measure to encourage stronger growth.

Nick Matthews, a senior economist at Nomura International, said: "We do not expect a strong recovery in the eurozone.

"It puts pressure on the ECB to deliver even more conventional and non-conventional measures," he added.

The European Central Bank is due to meet next week.

BBC

Unemployment in the eurozone has reached another record high, according to official figures.

The seasonally-adjusted rate for April was 12.2%, up from 12.1% the month before.

An extra 95,000 people were out of work in the 17 countries that use the euro, taking the total to 19.38 million.

Both Greece and Spain have jobless rates above 25%. The lowest unemployment rate is in Austria at 4.9%.

The European Commission's statistics office, Eurostat, said Germany had an unemployment rate of 5.4% while Luxembourg's was 5.6%.

The highest jobless rates are in Greece (27.0% in February 2013), Spain (26.8%) and Portugal (17.8%).

In France, Europe's second largest economy, the number of jobless people rose to a new record high in April.

"We do not see a stabilisation in unemployment before the middle of next year," said Frederik Ducrozet, an economist at Credit Agricole in Paris. "The picture in France is still deteriorating."

'Social crisis'

Youth unemployment remains a particular concern. In April, 3.6 million people under the age of 25 were out of work in the eurozone, which translated to an unemployment rate of 24.4%.

Figures from the Italian government showed 40.5% of young people in Italy are unemployed.

"We have to deal with the social crisis, which is expressed particularly in spreading youth unemployment, and place it at the centre of political action," said Italy's President Giorgio Napolitano.

In the 12 months to April, 1.6 million people lost their jobs in the eurozone.

While the jobless figure in the eurozone climbed for the 24th consecutive month, the unemployment rate for the full 27-member European Union remained at 11%.

The eurozone is in its longest recession since it was created in 1999. At 1.4%, inflation is far below the 2% target set by the European Central Bank (ECB).

Consumer spending remains subdued. Figures released on Friday showed that retail sales in Germany fell 0.4% in April compared with the previous month.

Earlier this week, the Organisation for Economic Co-operation and Development (OECD) predicted that the eurozone economy would contract by 0.6% this year.

According to Carsten Brzeski, an economist at ING, in the past, the eurozone has needed economic growth of about 1.5% to create jobs.

ECB action?

Some consider that the ECB needs to do more than simply cutting interest rates to boost economic activity and create jobs.

Earlier this month, the ECB lowered its benchmark interest rate to 0.50% from 0.75%, the first cut in 10 months, and said it was "ready to act if needed" if more measures were required to boost the eurozone's economic health.

In its report earlier this week, the OECD hinted that the ECB might want to expand quantitative easing (QE) as a measure to encourage stronger growth.

Nick Matthews, a senior economist at Nomura International, said: "We do not expect a strong recovery in the eurozone.

"It puts pressure on the ECB to deliver even more conventional and non-conventional measures," he added.

The European Central Bank is due to meet next week.

BBC

RealGunner- Admin

- Club Supported :

Posts : 89513

Join date : 2011-06-05

Re: Euro Crisis Returns

Re: Euro Crisis Returns

Something about Greece

Talk of recovery in Greece is premature – and all about justifying austerity

Perhaps you remember reading about a basket case called Greece. The first domino to fall in the eurozone crisis, it was officially broke and only kept afloat by hundreds of billions in euros from Europe and the IMF. To secure the loans, Athens had to slash spending, lay off or cut pay for thousands of public servants and flog state assets. The result was social uproar, political turmoil and economic collapse. Hundreds of thousands of Greeks took to the streets. The country faced ejection from the euro, what economists drolly dubbed a "Grexit". In short, it was in a deep hole. But if that's your image of Greece then you need to update it: that's so spring/summer 2012.

Over the past few weeks, Athens' top brass have been trying to convince the world that happy days are here again. Prime minister Antonis Samaras now talks of the Greek "success story". The boss of the central bank and the finance minister say Greece has turned a corner. Editorialists in the national press and parts of the international financial press dutifully nod their assent. And those with Greek or European assets to sell clap along: "Forget Grexit – it could be Greecovery instead," ran one particularly bone-headed "research" note I received on Friday.

What's at stake here is a much bigger prize than whether an economy worth 2% of Europe's annual GDP really is on the mend. It's about justifying the shock therapy imposed on distressed members of the eurozone.

This was frankly put by Maria Paola Toschi, a market strategist at JP Morgan, in the FT last week. "If Greece can present itself as a recovering economy, having taken the medicine of fiscal austerity and supply-side reform, then the reform agenda of the European Central Bank and International Monetary Fund will be given a further boost."

If the elites of Europe and Washington can claim to have "healed" Greece, then they can shrug off criticisms of eurozone austerity. And they can also defend an economic model that just three years ago looked as if it had crashed into a wall.

Yet the exhibits the boosters are using do not a case make. Athens shares doubled in the past year? Cheap money from central banks and investors desperate for returns can play funny tricks. Wages have fallen? Yes, but the business investment that was meant to follow on from that hasn't materialised. The public finances are back in some kind of order? Taking an axe to the welfare state and public services will do that; still, few think Athens could go a day outside the sovereign version of debtor's jail.

And no one is seriously disputing that the economy remains badly sick; the OECD predicts Greece will face its seventh year of recession in a row in 2014. More than one in four Greeks are out of a job; of young Greeks, nearly two in three. Around 60% of those out of work haven't been employed in more than a year. According to a recent piece by Nick Malkoutzis and Yiannis Mouzakis for Ekathimerini, there are 400,000 families in Greece without a single breadwinner.

Although I was one of those who opposed the austerity imposed in Greece from the outset, I would far rather have been proved wrong. As someone who reported from Athens on a few occasions in 2011, and who has a number of Greek friends, I'd like to see them flourishing.

As it is, the most that can be said for the elusive recovery is that Germany and the rest of Europe have decided to keep Athens in the single currency and to keep supplying it with euros. From that has come a measure of financial stability which has attracted investors. The silent run on the banks, with savers pulling out their money, has stopped; but the financial institutions now function more like deposit vaults than dispensers of credit. And there have been some important cultural and institutional changes, as fund manager Jason Manolopoulos points out. Before the crisis, the government didn't know how many civil servants it employed; now it does. And, should you wish to trade in the middle of a depression, it has got easier and cheaper to set up a business.

But pit those gains against the near-collapse of the health system, the rise of the neo-Nazi Golden Dawn and the clampdown on investigative journalists such as Kostas Vaxevanis, persecuted for publishing a list of super-rich tax dodgers.

While the economy remains catatonic and civil society is in crisis, all such boosterism amounts to is a 21st-century version of claiming the operation was successful; it's just a shame the patient died. It's a more dramatic variant of something George Osborne and the austerity crowd are trying in the UK, too: to define down what success looks like.

Two summers ago, I sat with economist Yanis Varoufakis on his balcony overlooking the Acropolis, and asked him to sum up the outlook for Greece. "It's in freefall." Last night, I asked him the same question. "It's still in freefall."

Then he told me a story. Last year, his book The Global Minotaur was a bestseller in Greece, ahead even of Fifty Shades of Grey. But, he said, he had not received a cent in royalties. Why not? His publisher hadn't received any money from the bookshops, which were all bust. Rather than chase them, put booksellers out of business and finally kiss goodbye to getting any money, the publisher preferred to leave it be. So the shops, the imprint and the author all got by on nothing.

That sweet little story of economic inertia seems to me to say a lot.

Guardian

Talk of recovery in Greece is premature – and all about justifying austerity

Perhaps you remember reading about a basket case called Greece. The first domino to fall in the eurozone crisis, it was officially broke and only kept afloat by hundreds of billions in euros from Europe and the IMF. To secure the loans, Athens had to slash spending, lay off or cut pay for thousands of public servants and flog state assets. The result was social uproar, political turmoil and economic collapse. Hundreds of thousands of Greeks took to the streets. The country faced ejection from the euro, what economists drolly dubbed a "Grexit". In short, it was in a deep hole. But if that's your image of Greece then you need to update it: that's so spring/summer 2012.

Over the past few weeks, Athens' top brass have been trying to convince the world that happy days are here again. Prime minister Antonis Samaras now talks of the Greek "success story". The boss of the central bank and the finance minister say Greece has turned a corner. Editorialists in the national press and parts of the international financial press dutifully nod their assent. And those with Greek or European assets to sell clap along: "Forget Grexit – it could be Greecovery instead," ran one particularly bone-headed "research" note I received on Friday.

What's at stake here is a much bigger prize than whether an economy worth 2% of Europe's annual GDP really is on the mend. It's about justifying the shock therapy imposed on distressed members of the eurozone.

This was frankly put by Maria Paola Toschi, a market strategist at JP Morgan, in the FT last week. "If Greece can present itself as a recovering economy, having taken the medicine of fiscal austerity and supply-side reform, then the reform agenda of the European Central Bank and International Monetary Fund will be given a further boost."

If the elites of Europe and Washington can claim to have "healed" Greece, then they can shrug off criticisms of eurozone austerity. And they can also defend an economic model that just three years ago looked as if it had crashed into a wall.

Yet the exhibits the boosters are using do not a case make. Athens shares doubled in the past year? Cheap money from central banks and investors desperate for returns can play funny tricks. Wages have fallen? Yes, but the business investment that was meant to follow on from that hasn't materialised. The public finances are back in some kind of order? Taking an axe to the welfare state and public services will do that; still, few think Athens could go a day outside the sovereign version of debtor's jail.

And no one is seriously disputing that the economy remains badly sick; the OECD predicts Greece will face its seventh year of recession in a row in 2014. More than one in four Greeks are out of a job; of young Greeks, nearly two in three. Around 60% of those out of work haven't been employed in more than a year. According to a recent piece by Nick Malkoutzis and Yiannis Mouzakis for Ekathimerini, there are 400,000 families in Greece without a single breadwinner.

Although I was one of those who opposed the austerity imposed in Greece from the outset, I would far rather have been proved wrong. As someone who reported from Athens on a few occasions in 2011, and who has a number of Greek friends, I'd like to see them flourishing.

As it is, the most that can be said for the elusive recovery is that Germany and the rest of Europe have decided to keep Athens in the single currency and to keep supplying it with euros. From that has come a measure of financial stability which has attracted investors. The silent run on the banks, with savers pulling out their money, has stopped; but the financial institutions now function more like deposit vaults than dispensers of credit. And there have been some important cultural and institutional changes, as fund manager Jason Manolopoulos points out. Before the crisis, the government didn't know how many civil servants it employed; now it does. And, should you wish to trade in the middle of a depression, it has got easier and cheaper to set up a business.

But pit those gains against the near-collapse of the health system, the rise of the neo-Nazi Golden Dawn and the clampdown on investigative journalists such as Kostas Vaxevanis, persecuted for publishing a list of super-rich tax dodgers.

While the economy remains catatonic and civil society is in crisis, all such boosterism amounts to is a 21st-century version of claiming the operation was successful; it's just a shame the patient died. It's a more dramatic variant of something George Osborne and the austerity crowd are trying in the UK, too: to define down what success looks like.

Two summers ago, I sat with economist Yanis Varoufakis on his balcony overlooking the Acropolis, and asked him to sum up the outlook for Greece. "It's in freefall." Last night, I asked him the same question. "It's still in freefall."

Then he told me a story. Last year, his book The Global Minotaur was a bestseller in Greece, ahead even of Fifty Shades of Grey. But, he said, he had not received a cent in royalties. Why not? His publisher hadn't received any money from the bookshops, which were all bust. Rather than chase them, put booksellers out of business and finally kiss goodbye to getting any money, the publisher preferred to leave it be. So the shops, the imprint and the author all got by on nothing.

That sweet little story of economic inertia seems to me to say a lot.

Guardian

RealGunner- Admin

- Club Supported :

Posts : 89513

Join date : 2011-06-05

Re: Euro Crisis Returns

Re: Euro Crisis Returns

Pound falls as Bank of England plays down rate rise

The pound has fallen sharply after the Bank of England warned that markets were wrong to assume that it would start raising interest rates soon.

Sterling immediately dropped a cent and a half against the dollar to $1.5141.

It came as the Bank held interest rates at 0.5% and kept its quantitative easing programme (QE) unchanged.

The decisions were made at the first meeting of the Bank's Monetary Policy Committee since Mark Carney took over as governor from Sir Mervyn King.

Share prices rallied in London in anticipation of the further continuation of cheap borrowing costs.

The FTSE 100 index jumped 50 points on the news, and later gained a further lift from a promise by the European Central Bank to keep eurozone rates low, taking it to 3% up for the day.

The unusual statement by the Bank's Monetary Policy Committee (MPC) comes as the economy shows signs of recovery, with several industry surveys pointing to rising business optimism.

Earlier on Thursday the Halifax reported that house prices across the UK were 3.7% higher in the three months to June than a year ago, adding to evidence that the property market is on the rebound, particularly in the South East.

'Not warranted'

The MPC said that the recovery "remains weak by historical standards and a degree of slack is expected to persist for some time".

The positive developments in the economy have also been tempered by a sharp rise on global markets in the long-term cost of borrowing - something that has caught central banks worldwide by surprise.

In light of the market movements, "the implied rise in the expected future path of Bank Rate was not warranted by the recent developments in the domestic economy," the MPC said.

The Bank has held short-term interest rates at their current historic low level since March 2009.

However, last month markets brought forward their expectations for when interest rates in the UK - as well as in the US and other major economies - would start rising again.

It came after a statement from the US Federal Reserve laying out a timetable for withdrawing its own QE programme was taken as a signal by markets that the era of cheap money was coming to an end, and sent stock markets, commodity and bond prices lower worldwide.

The Bank's statement immediately scaled back those expectations in the sterling money markets.

Even so, the Bank is still expected by markets to raise interest rates by a quarter-point within the next 12 months. Back in April, markets did not expect any change in monetary policy over the coming year or more.

With interest rates expected to remain low for longer, the pound became less attractive on currency markets, sending sterling lower.

The pound also fell sharply against the euro, before rebounding an hour and a half later as the European Central Bank committed to maintaining its interest rates at or below their current level for an "extended period of time", sending the euro lower against all currencies.

Forward guidance?

The Bank of England's move may also herald a change in style with the change of governor.

Mark Carney, who has just taken over, is known from his time heading Canada's central bank for favouring "forward guidance" - providing markets with explicit statements about the Bank's future plans, in order to manipulate longer-term interest rates.

The MPC has been asked by the Chancellor George Osborne to make the case for forward guidance in a report to be delivered alongside the August inflation report.

The Bank said the analysis "would have an important bearing on the committee's policy discussions in August".

"This is close to the MPC issuing forward guidance in July, instead of waiting until August," said David Tinsley, UK economist at BNP Paribas.

"It is clear from the statement that they are looking to forward guidance as a key tool in massaging yields and expected Bank Rate lower.

"It is newsworthy in itself that despite better data, the committee as a whole agreed this common view. It suggests at this early stage that Mr Carney is both dovish leaning and very much in charge."

Voting split

Although the no change in policy was widely anticipated by markets, there is likely to be keener market interest than usual in the voting pattern at Thursday's meeting, when minutes are published on 17 July.

The MPC has been split in recent months over whether to increase QE from its current level of £375bn, and the outgoing governor, Sir Mervyn, was among the minority voting in favour of an increase.

It is unclear which way Mr Carney is likely to have voted on the issue, particularly in light of the stronger economic recovery, as well as the recent market jitters over future interest rates.

Further complicating the picture, inflation in the UK remains doggedly high - consumer prices rose 2.7% in May, well above the Bank's 2% target.

Inflation has been above target since 2009, and has been stuck in the 2%-3% range for the past year, having previously fallen from 5%.

The Bank has thus far turned a blind eye to the inflation overshoot - something that is not expected to change under Mr Carney.

Wage rises have consistently failed to keep up with rising shop prices, and this has undermined the purchasing power of households and dampened consumer spending.

BBC

_________________________________________________

Terrible

The pound has fallen sharply after the Bank of England warned that markets were wrong to assume that it would start raising interest rates soon.

Sterling immediately dropped a cent and a half against the dollar to $1.5141.

It came as the Bank held interest rates at 0.5% and kept its quantitative easing programme (QE) unchanged.

The decisions were made at the first meeting of the Bank's Monetary Policy Committee since Mark Carney took over as governor from Sir Mervyn King.

Share prices rallied in London in anticipation of the further continuation of cheap borrowing costs.

The FTSE 100 index jumped 50 points on the news, and later gained a further lift from a promise by the European Central Bank to keep eurozone rates low, taking it to 3% up for the day.

The unusual statement by the Bank's Monetary Policy Committee (MPC) comes as the economy shows signs of recovery, with several industry surveys pointing to rising business optimism.

Earlier on Thursday the Halifax reported that house prices across the UK were 3.7% higher in the three months to June than a year ago, adding to evidence that the property market is on the rebound, particularly in the South East.

'Not warranted'

The MPC said that the recovery "remains weak by historical standards and a degree of slack is expected to persist for some time".

The positive developments in the economy have also been tempered by a sharp rise on global markets in the long-term cost of borrowing - something that has caught central banks worldwide by surprise.

In light of the market movements, "the implied rise in the expected future path of Bank Rate was not warranted by the recent developments in the domestic economy," the MPC said.

The Bank has held short-term interest rates at their current historic low level since March 2009.

However, last month markets brought forward their expectations for when interest rates in the UK - as well as in the US and other major economies - would start rising again.

It came after a statement from the US Federal Reserve laying out a timetable for withdrawing its own QE programme was taken as a signal by markets that the era of cheap money was coming to an end, and sent stock markets, commodity and bond prices lower worldwide.

The Bank's statement immediately scaled back those expectations in the sterling money markets.

Even so, the Bank is still expected by markets to raise interest rates by a quarter-point within the next 12 months. Back in April, markets did not expect any change in monetary policy over the coming year or more.

With interest rates expected to remain low for longer, the pound became less attractive on currency markets, sending sterling lower.

The pound also fell sharply against the euro, before rebounding an hour and a half later as the European Central Bank committed to maintaining its interest rates at or below their current level for an "extended period of time", sending the euro lower against all currencies.

Forward guidance?

The Bank of England's move may also herald a change in style with the change of governor.

Mark Carney, who has just taken over, is known from his time heading Canada's central bank for favouring "forward guidance" - providing markets with explicit statements about the Bank's future plans, in order to manipulate longer-term interest rates.

The MPC has been asked by the Chancellor George Osborne to make the case for forward guidance in a report to be delivered alongside the August inflation report.

The Bank said the analysis "would have an important bearing on the committee's policy discussions in August".

"This is close to the MPC issuing forward guidance in July, instead of waiting until August," said David Tinsley, UK economist at BNP Paribas.

"It is clear from the statement that they are looking to forward guidance as a key tool in massaging yields and expected Bank Rate lower.

"It is newsworthy in itself that despite better data, the committee as a whole agreed this common view. It suggests at this early stage that Mr Carney is both dovish leaning and very much in charge."

Voting split

Although the no change in policy was widely anticipated by markets, there is likely to be keener market interest than usual in the voting pattern at Thursday's meeting, when minutes are published on 17 July.

The MPC has been split in recent months over whether to increase QE from its current level of £375bn, and the outgoing governor, Sir Mervyn, was among the minority voting in favour of an increase.

It is unclear which way Mr Carney is likely to have voted on the issue, particularly in light of the stronger economic recovery, as well as the recent market jitters over future interest rates.

Further complicating the picture, inflation in the UK remains doggedly high - consumer prices rose 2.7% in May, well above the Bank's 2% target.

Inflation has been above target since 2009, and has been stuck in the 2%-3% range for the past year, having previously fallen from 5%.

The Bank has thus far turned a blind eye to the inflation overshoot - something that is not expected to change under Mr Carney.

Wage rises have consistently failed to keep up with rising shop prices, and this has undermined the purchasing power of households and dampened consumer spending.

BBC

_________________________________________________

Terrible

RealGunner- Admin

- Club Supported :

Posts : 89513

Join date : 2011-06-05

Re: Euro Crisis Returns

Re: Euro Crisis Returns

What is terrible about that RG? As I see it that is very good news.

Here is the financial times:

The UK Treasury has asked the BoE to comment on the economic variables it could use as intermediate thresholds, while keeping to its ultimate 2 per cent inflation target. The BoE is likely to use some measure of slack in the economy, connecting a future tightening of policy to the moment spare capacity is judged to have fallen sufficiently as the recovery progresses.

Sadly, measures of UK slack are erratic at the moment. There is no possible way to be polite: all are useless for the task of guidance.

Inflation – the ultimate measure – is forecast to be above the 2 per cent target for the next two years, suggesting no slack, which no sensible person believes. Unemployment is no better as a measure. Its relationship to the rest of the economy has broken down since 2008, so following the Fed’s guidance would involve linking policy to a variable we do not understand. That makes no sense.

The output gap cannot be observed and a range of cyclical indicators, once preferred as markers of slack by the Office for Budget Responsibility, have behaved so strangely that they provide no help either. Since we have no idea whether the pre-crisis trend of output was sustainable, the gap between real or nominal output today and a continuation of pre-crisis trends is also useless.

The lack of a reliable measure of UK slack should not spell the end of Mr Carney’s ambitions. He just needs to go back to first principles and provide some certainty on policy related to the variables that matter for Britain’s economic health.

There is little mystery. The economy has been chronically short of growth in spending on British stuff. I could use the technical term, nominal gross domestic product growth, but the colloquial shorthand is better and easy for households and companies to understand.

Sensible policy should therefore continue with loose monetary policy until spending on UK-produced goods and services has risen to an annual rate of at least 4.5 per cent for two years. An inflation backstop is required to prevent any wage-price spiral, but given the weakness of pay growth, it is highly unlikely to be a constraint. Policy guidance is a good idea, whose time has come. But it must be linked to an economic variable that matters. In the UK, that is spending growth.

Here is the financial times:

The UK Treasury has asked the BoE to comment on the economic variables it could use as intermediate thresholds, while keeping to its ultimate 2 per cent inflation target. The BoE is likely to use some measure of slack in the economy, connecting a future tightening of policy to the moment spare capacity is judged to have fallen sufficiently as the recovery progresses.

Sadly, measures of UK slack are erratic at the moment. There is no possible way to be polite: all are useless for the task of guidance.

Inflation – the ultimate measure – is forecast to be above the 2 per cent target for the next two years, suggesting no slack, which no sensible person believes. Unemployment is no better as a measure. Its relationship to the rest of the economy has broken down since 2008, so following the Fed’s guidance would involve linking policy to a variable we do not understand. That makes no sense.

The output gap cannot be observed and a range of cyclical indicators, once preferred as markers of slack by the Office for Budget Responsibility, have behaved so strangely that they provide no help either. Since we have no idea whether the pre-crisis trend of output was sustainable, the gap between real or nominal output today and a continuation of pre-crisis trends is also useless.

The lack of a reliable measure of UK slack should not spell the end of Mr Carney’s ambitions. He just needs to go back to first principles and provide some certainty on policy related to the variables that matter for Britain’s economic health.

There is little mystery. The economy has been chronically short of growth in spending on British stuff. I could use the technical term, nominal gross domestic product growth, but the colloquial shorthand is better and easy for households and companies to understand.

Sensible policy should therefore continue with loose monetary policy until spending on UK-produced goods and services has risen to an annual rate of at least 4.5 per cent for two years. An inflation backstop is required to prevent any wage-price spiral, but given the weakness of pay growth, it is highly unlikely to be a constraint. Policy guidance is a good idea, whose time has come. But it must be linked to an economic variable that matters. In the UK, that is spending growth.

BarrileteCosmico- Admin

- Club Supported :

Posts : 28292

Join date : 2011-06-05

Age : 33

Re: Euro Crisis Returns

Re: Euro Crisis Returns

UK wages decline among worst in Europe

Wages in the UK have seen one of the largest falls in the European Union during the economic downturn, according to official figures.

Figures from the House of Commons library show average hourly wages have fallen 5.5% since mid-2010, adjusted for inflation, which is the fourth-worst decline in the 27-nation bloc.

By contrast, German hourly wages rose by 2.7% over the same period.

Across the European Union as a whole, average wages fell 0.7%.

Only Greek, Portuguese and Dutch workers have had a steeper decline in hourly wages, the figures showed.

Other countries that have suffered during the eurozone debt crisis also fared better than the UK. Spain had a 3.3% drop over the same period and salaries in Cyprus fell by 3%.

French workers saw a 0.4% increase, while the 18 countries in the eurozone saw a 0.1% drop during that period.

'Worse off'

"These figures show the full scale of David Cameron's cost of living crisis," said shadow Treasury minister Cathy Jamieson.

"Working people are not only worse off under the Tories, we're also doing much worse than almost all other EU countries.

"Despite out-of-touch claims by ministers, life is getting harder for ordinary families as prices continue rising faster than wages."

But the government says it has tackled the higher cost of living by raising the tax-free personal allowance threshold to £10,000, taking 2.7 million people out of tax, and other measures such as freezing fuel duty.

"The economy is on the mend, but we've still got a long way to go as we move from rescue to recovery and we appreciate that times are still tough for families," a Treasury spokesperson said.

The GMB union said the government was "directly responsible" for the fall in wages.

"Employers paying low wages get taxpayer subsidies in the form of tax credits to assemble a workforce for them to make decent profit margins," it said.

In June, the Institute for Fiscal Studies said that a third of workers who stayed in the same job saw a wage cut or freeze between 2010 and 2011 amid a rise in the cost of living.

"The falls in nominal wages... during this recession are unprecedented," the IFS said at the time.

In 2009, the average public-sector worker earned about £16.60 per hour, which dropped to about £15.80 in 2011, the IFS said.

Meanwhile, hourly pay for private-sector workers in 2009 was just over £15.10 and dropped to about £13.60 in 2011.

BBC

Wages in the UK have seen one of the largest falls in the European Union during the economic downturn, according to official figures.

Figures from the House of Commons library show average hourly wages have fallen 5.5% since mid-2010, adjusted for inflation, which is the fourth-worst decline in the 27-nation bloc.

By contrast, German hourly wages rose by 2.7% over the same period.

Across the European Union as a whole, average wages fell 0.7%.

Only Greek, Portuguese and Dutch workers have had a steeper decline in hourly wages, the figures showed.

Other countries that have suffered during the eurozone debt crisis also fared better than the UK. Spain had a 3.3% drop over the same period and salaries in Cyprus fell by 3%.

French workers saw a 0.4% increase, while the 18 countries in the eurozone saw a 0.1% drop during that period.

'Worse off'

"These figures show the full scale of David Cameron's cost of living crisis," said shadow Treasury minister Cathy Jamieson.

"Working people are not only worse off under the Tories, we're also doing much worse than almost all other EU countries.

"Despite out-of-touch claims by ministers, life is getting harder for ordinary families as prices continue rising faster than wages."

But the government says it has tackled the higher cost of living by raising the tax-free personal allowance threshold to £10,000, taking 2.7 million people out of tax, and other measures such as freezing fuel duty.

"The economy is on the mend, but we've still got a long way to go as we move from rescue to recovery and we appreciate that times are still tough for families," a Treasury spokesperson said.

The GMB union said the government was "directly responsible" for the fall in wages.

"Employers paying low wages get taxpayer subsidies in the form of tax credits to assemble a workforce for them to make decent profit margins," it said.

In June, the Institute for Fiscal Studies said that a third of workers who stayed in the same job saw a wage cut or freeze between 2010 and 2011 amid a rise in the cost of living.

"The falls in nominal wages... during this recession are unprecedented," the IFS said at the time.

In 2009, the average public-sector worker earned about £16.60 per hour, which dropped to about £15.80 in 2011, the IFS said.

Meanwhile, hourly pay for private-sector workers in 2009 was just over £15.10 and dropped to about £13.60 in 2011.

BBC

RealGunner- Admin

- Club Supported :

Posts : 89513

Join date : 2011-06-05

Re: Euro Crisis Returns

Re: Euro Crisis Returns

Wages falling a bit if unemployment improves (which it has in the UK) is fine. In an ideal world, you have improvement in both. But if you were to pick one that you'd want to see improvement in, it would be unemployment very clearly.

Of course, you have France where unemployment has reached record highs and wages rise

Of course, you have France where unemployment has reached record highs and wages rise

sportsczy- Ballon d'Or Contender

- Club Supported :

Posts : 21475

Join date : 2011-12-07

Re: Euro Crisis Returns

Re: Euro Crisis Returns

Euro crisis, unemployment rates.. what's that?

Thimmy- World Class Contributor

- Club Supported :

Posts : 13141

Join date : 2011-06-05

Age : 35

Re: Euro Crisis Returns

Re: Euro Crisis Returns

I don't want to sound like an Idiot cuz i am not European

but given the evidence and fact that the British and Swiss ( some of Europes best bankers) did not join the Eurozone for currency

why the fvck did other European countries decide not to just develop their own currencies, surely the Pounds and Francs boys knew this would happen.

as lately, anyone who watches Bloomberg or any Busines channel would know that the US is doing much better ( thanks to Fed injecting money and saving companies like Tesla which would later pay back their loans, NOW WHY THE FVCK DID SOME EUROPEAN COUNTRIES NOT HAVE A PROPER FEDERAL RESERVE?)

id on't understand mainland European accounting,, and its not making sense to most of us outside the continent

but given the evidence and fact that the British and Swiss ( some of Europes best bankers) did not join the Eurozone for currency

why the fvck did other European countries decide not to just develop their own currencies, surely the Pounds and Francs boys knew this would happen.

as lately, anyone who watches Bloomberg or any Busines channel would know that the US is doing much better ( thanks to Fed injecting money and saving companies like Tesla which would later pay back their loans, NOW WHY THE FVCK DID SOME EUROPEAN COUNTRIES NOT HAVE A PROPER FEDERAL RESERVE?)

id on't understand mainland European accounting,, and its not making sense to most of us outside the continent

aleumdance- First Team

- Club Supported :

Posts : 2943

Join date : 2011-12-11

Re: Euro Crisis Returns

Re: Euro Crisis Returns

Ryan Avent telling it like it is:

LAST week I reckoned that one shouldn't be too hard on Germany where its current-account surpluses are concerned, since their deflationary impact could easily be offset by looser monetary policy at the European Central Bank. But I added a proviso: